Two companies have teamed up to debut automated packaging equipment they say is the first of its kind to hit the market and could be a game changer for e-commerce.

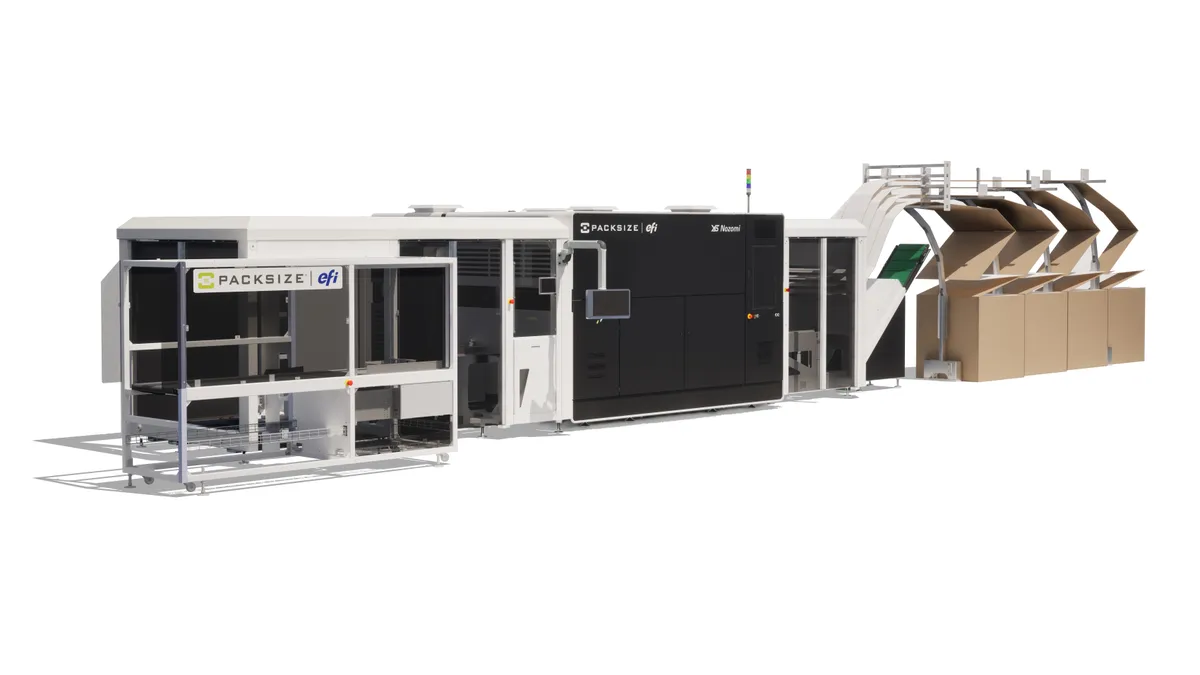

The X5 Nozomi makes and decorates customized, assembled cardboard boxes on demand. It combines the Nozomi single-pass digital inkjet printer for corrugated media from printing equipment manufacturer EFI with the X5 on-demand, rightsized box-making machinery from packaging and equipment supplier Packsize.

The companies designed the integrated technology “for distribution centers, for companies that deliver several products consolidated in one box,” said Evandro Matteucci, vice president and general manager of EFI’s inkjet packaging and building materials businesses. The individual technologies are not new, he said, but together they now they act as subsystems in a broader system.

This type of automated machinery “as an end-to-end solution, with print and die cutting capabilities,” is new to the market, confirmed Jeff Wettersten, vice president of packaging at consultancy Keypoint Intelligence. “There have been products on the marketplace for a number of years now for custom structure size,” he said, but those haven’t offered printing as an additional function.

From start to finish

EFI decided to bring its digital printing technologies into the corrugated market with the introduction of its first Nozomi printer in 2016, Matteucci explained. Then, three years ago, the company “asked, how can we continue to disrupt this market? And we met this company called Packsize,” he said.

Following years of R&D work, the partners unveiled their innovation on May 28 at Drupa, dubbed the largest printing equipment exhibition in the world. The event takes place in Germany every four years.

“It was such an attraction at Drupa. Everybody was looking at this product and wanted to know more,” said Jean Lloyd, a global principal analyst at Keypoint Intelligence, who attended the conference.

The partner companies say their innovation reduces the steps needed to create custom sized and decorated boxes. Its “walkaway” automation allows one operator to oversee four or five X5 Nozomis, Matteucci said. “We don’t need a dedicated operator ... because it’s all fully integrated in the cloud.”

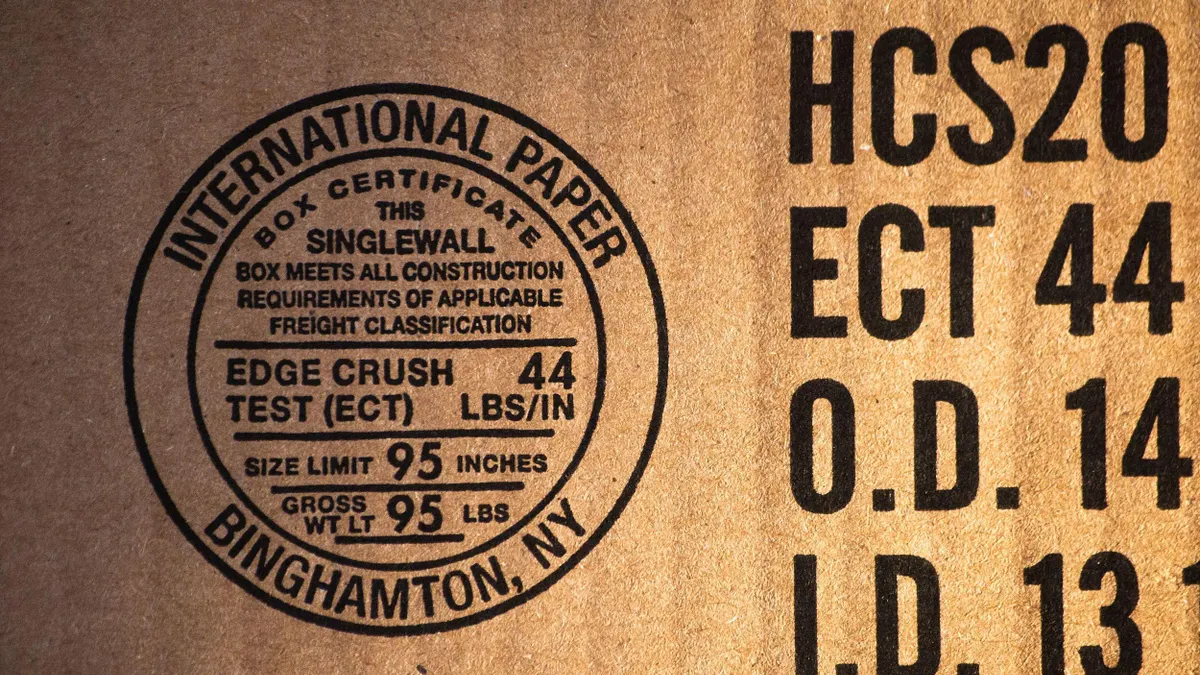

Four different sizes of fanfold corrugated sheets feed into the X5 Nozomi. The machine’s computer system determines how large a box needs to be for each individual order. The computer system then sends information about where the sheet should be cut to make a box of that size.

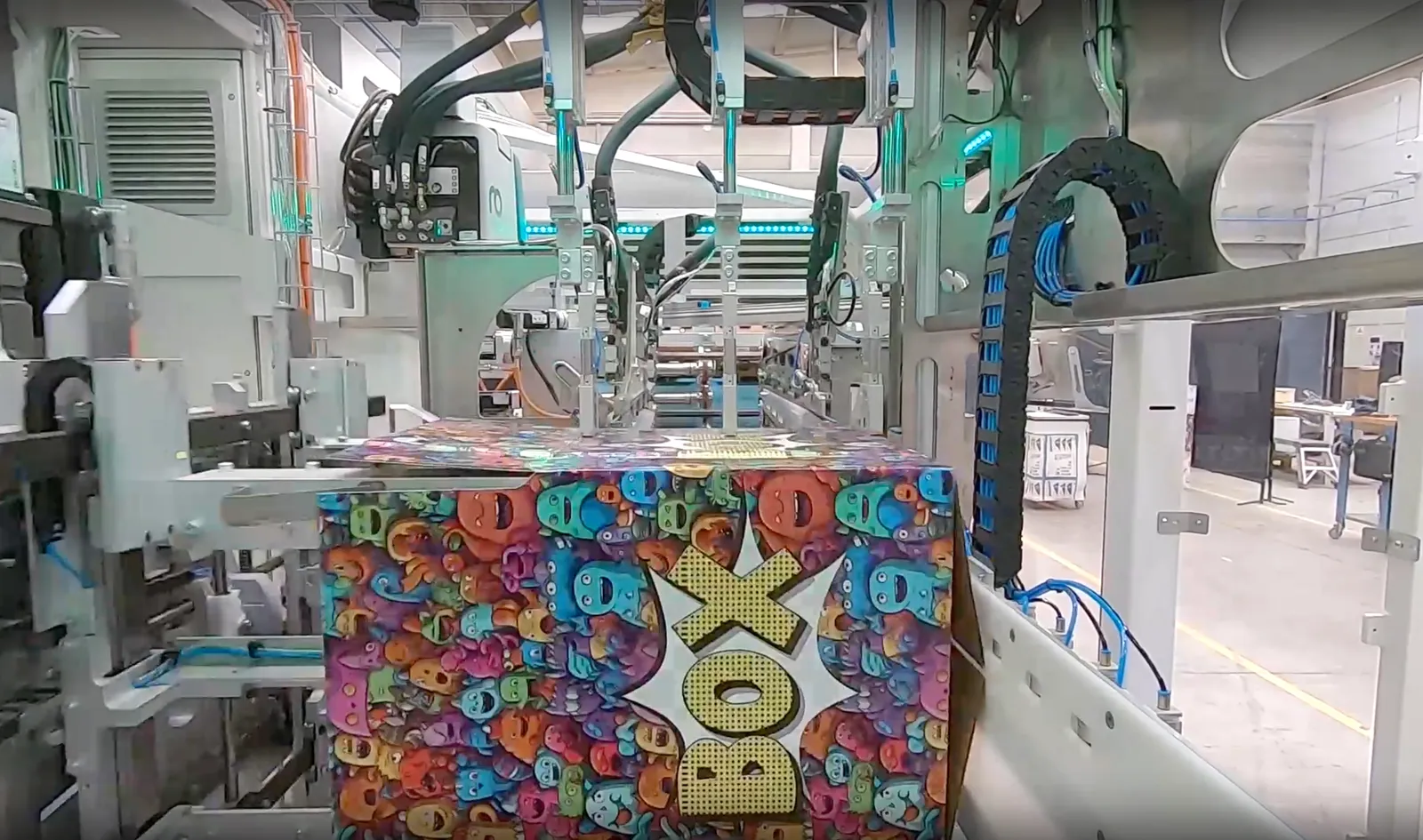

On the printing side, the computer system interprets the digital design file and scales it to the appropriate size for each box. The corrugated sheet is sprayed with ultraviolet LED ink droplets as it passes under the inkjets to print the design. Then the box passes through die-cutting machinery and is hot-glued into its finished form.

The system delivers a box every six seconds, or about 600 boxes per hour. Packsize’s X5 alone produces boxes at about the same rate, whereas its X7 unit, also without decoration capabilities, takes a little more than half that time.

The system’s variable data printing capabilities mean each box can be decorated with different imagery, Matteucci said. Variable printing has yet to take off much in the packaging space, Lloyd said, due to the complexity and sheer amount of data needed. The market for variable printing on packaging is still quite niche, she added, and many customers instead opt for package versioning.

Digital inkjet printing is heralded as a way to boost consumers’ unboxing experiences. Brands view customization and personalization as key ways to connect with and engage consumers, which can enhance the likelihood of repeat purchases.

The full-color, high resolution graphics the X5 Nozomi produces offer a more engaging experience than just a standard brown box, Matteucci said. And brands’ ability to monetize the box itself with on-box marketing and advertising, “a new branding platform,” is a key selling point for the system, he said.

Brands have responded strongly and positively to on-box advertising, Lloyd said, “because if you look at the whole chain of the package, it’s going to be crossing a lot of paths. And there’s a lot of advertising that will get noticed.”

Sustainability is another leading benefit of the system, according to Matteucci, because rightsized boxes typically use less material per order than pre-cut types and could require less or no filler to protect products. Plus, printing messaging directly onto a box could eliminate the need for separate labels, further reducing the amount of materials used. There is wasteage, however, in the form of cut-offs from the rightsizing process.

Developing the market

While EFI and Packsize currently lead the market with their equipment release, others are on their heels.

For instance, competitor Ranpak, which develops rightsized box-making equipment, confirmed that it has been working on its own system for producing rightsized boxes with exterior decoration. A spokesperson said the company expects to release the product next year.

Others are likely to follow soon, as brands and e-commerce companies increasingly seek innovative packaging options, according to Keypoint analysts. “One thing I saw at Drupa is people are looking for solutions,” Lloyd said. While the new equipment addresses a huge challenge and taps into a huge opportunity, “it’s early days” for this technology, she said, and its future has yet to be determined.

“You’ve got to look at the ROI, you’ve got to look at all kinds of things, and it’s got to make sense,” Lloyd said. “But I think a lot more products [like this] are going to be coming to market because there is a lot of opportunity.”

Technology developers have to overcome hurdles to tap into a market, not the least of which is cost. In general, new technologies are sold at a premium and the cost comes down over time with greater adoption. The same likely will prove true with this new packaging equipment, said Keypoint analysts.

“On-box advertising is nice, but is [this] going to have a cost structure” that appeals to customers? Wettersten asked. “Who absorbs a price increase, and are they willing to pay a premium? Is it the consumer? Is it the packer? Is it the brand?”

The question remains whether customers and consumers will shell out more for the type of on-demand branding and personalization that comes with integrated rightsized box-making and digital printing equipment. Matteucci suggested that monetizing boxes’ exterior real estate can help to offset the costs.

Another cost-related question is whether the system can achieve the scale customers desire to reach their daily volumes. For instance, if one Amazon distribution center ships 80,000 to 100,000 boxes in a 24-hour period, and one integrated machine makes 600 rightsized, decorated boxes an hour, the machine would only contribute to less than 20% of daily production, Wettersten estimated. The distribution center would need at least six machines just to reach the low-end of its daily volume estimate if every box that passes through were rightsized and decorated.

“Packaging markets, especially corrugated, are built for scale. This [equipment] is something built for scope and flexibility,” Wettersten said. But he offered a caveat: “This [equipment] is not intended for everything; it’s intended for a percentage of the business.”