Paper and packaging companies are exploring different investment ideas and business strategies as they try to weather tough industry conditions that have contributed to the 6% reduction in North American containerboard production capacity so far in 2025.

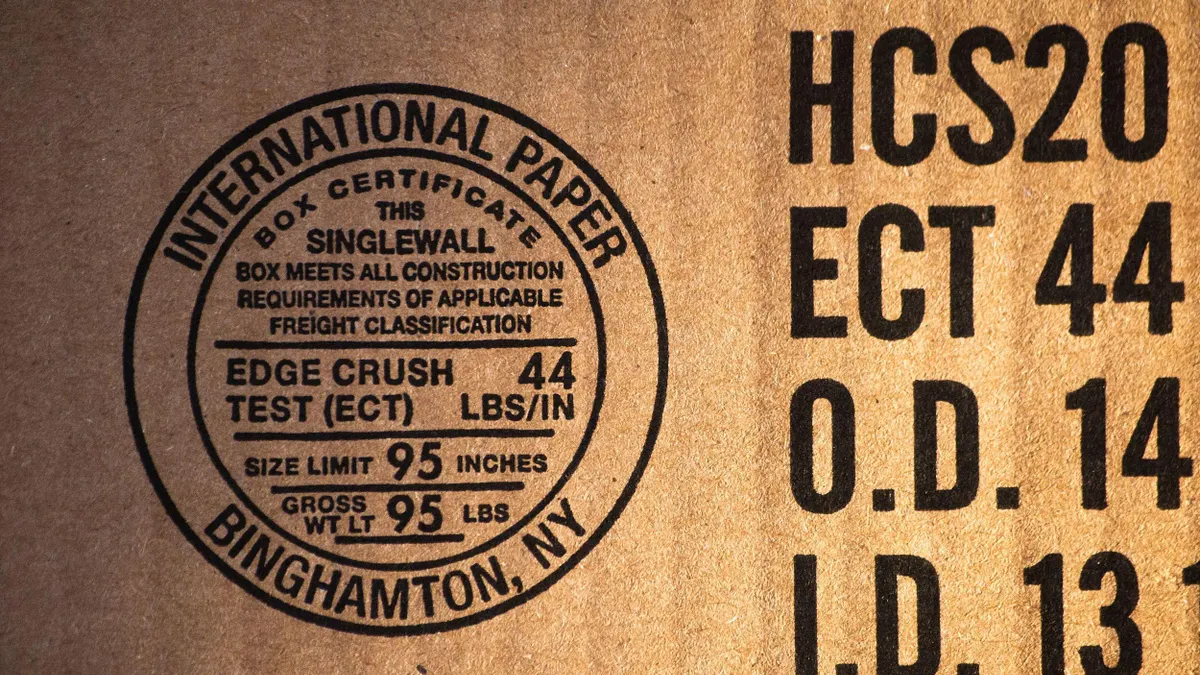

Containerboard production decreased both during the second quarter and first half of 2025, falling 5% and 3%, respectively, according to data from the American Forest & Paper Association. Fiber companies including Cascades, Georgia-Pacific, International Paper and Smurfit Westrock are among those that announced facility closures this year that contributed to the 6% pullback. And Greif announced in Q2 that it will sell its containerboard business to Packaging Corporation of America.

Observers are paying attention to whether these are early signals of a positive industry transformation driven by a rebalancing of supply and demand. Meantime, many of these companies’ earnings reports in recent weeks offer clues about in-progress or upcoming changes.

Some smaller and international fiber companies also released quarterly earnings data, with economic weakness emerging as a common thread. Here’s a roundup of key points from four paper and packaging companies’ recent earnings reports and calls.

Clearwater Paper

Net sales were $391.8 million during Clearwater Paper’s second quarter, up 13.8% compared with the prior year. That was largely driven by the integration of the Augusta mill that Clearwater acquired from Graphic Packaging International last year. The company had net income of $2.7 million, versus a $25.8 million net loss during the same quarter last year.

“We believe that we're in an industry down cycle, primarily driven by oversupply,” but demand softness should be temporary, said CEO Arsen Kitch on a July 29 earnings call. “It is difficult to predict when and how the industry will return to a mid-cycle utilization level.”

He pointed to an oversupply of solid bleached sulfate and said the industry’s utilization rate dropped from 84.7% in Q1 to 83.1% in Q2. “We believe that in a balanced supply and demand environment, utilization rates should be between 90% and 95%,” he said.

While Clearwater largely focuses on SBS, which Kitch said makes up about half of the total paperboard market, it’s looking to expand into coated unbleached kraft and coated recycled board. The course change might be partially prompted by competitor Sappi bringing online a newly converted SBS machine, suggested Michael Roxland, senior paper and packaging analyst at Truist Securities, in an Aug. 12 letter to investors.

Clearwater likely would enter the CRB market via an acquisition, Kitch said. But getting into CUK likely would involve altering an existing machine. The company is nearly finished with studies regarding CUK, and should make a decision about potential investments by year’s end, according to Kitch.

“We're focused on creating CUK capability on one of our existing SBS machines and not expanding our overall capacity” to enable swing production on an existing machine based on market demand, he explained. Initial estimates are around $50 million for such a project, which would take roughly 18 months.

Sappi

“It's been a challenging quarter marked by ongoing global economic weakness, partially, obviously, driven by the tariffs and the trade tensions, but broader macroeconomic challenges as well,” said Sappi CEO Stephen Binnie on the company’s fiscal third-quarter earnings call on Aug. 7. “That's had a significant impact on selling prices,” specifically on pulp but also on packaging and specialty grades.

Sappi reported $1.32 billion in revenue, down 3.6% year over year, and a net loss of $33 million for the quarter ending June 30.

The European market never fully recovered from COVID-19 pandemic impacts, Binnie said, and macroeconomic weakness is evident there along with “oversupply in many of the categories of paper.”

In May, Sappi restarted its newly converted No. 2 paper machine at its Somerset Mill in Skowhegan, Maine. Delays in starting production resulted in a $22 million negative impact to earnings. But the ramp-up for graphic paper production is now going as expected. Broadly speaking, “we're confident of filling the machine” with new and existing customer orders as production ramps further, Binnie said.

The company does not plan for major capital expenditure projects for the next few years. Its main focus will be on cost reduction and debt management, Binnie said.

Stora Enso

Market conditions remained challenging in the second quarter, but “we continued to make good progress in building a stronger and more competitive Stora Enso,” said CEO Hans Sohlstrom during a July 23 earnings call.

Q2 sales totaled 2.43 billion euros, approximately $2.83 billion, a 5.4% year-over-year increase. Executives expect markets to remain volatile at least through the next quarter.

As part of a broader company transformation, Stora Enso flattened its corporate structure as of July 1, executives said. It’s also working to deleverage and improve cost competitiveness. Already, the company is operating more efficiently than three years ago, Sohlstrom said.

Stora Enso entered an agreement in Q2 to divest more than 12% of its forest land in Sweden for 900 million euros, approximately $1.05 billion. The company is exploring options for its approximately 3 million acres of remaining Swedish forest assets, “including a potential separation and listing of the forest business through a demerger into a new company that would be wholly owned by all of Stora Enso shareholders,” Sohlstrom said.

Forestry and packaging are the company’s two main business units. Nearly 80% of the company’s investments over the last decade have been in packaging, and that focus will continue, Sohlstrom said.

The company’s mill in Oulu, Finland, is ramping up its new consumer packaging board production capacity. That will weigh on earnings in the short term but should prove beneficial for packaging sector growth down the road, Sohlstrom explained.

The trade situation has dampened companies’ outlooks and has many customers in “wait-and-see mode,” he said.

“U.S. President Trump's Liberation Day in the beginning of April caused uncertainty in general to the market, and probably that could be seen as somewhat weakening the outlook, the confidence in the marketplace and on consumers,” Sohlstrom said. “As we all know, uncertainty is not good for economic development and demand development.”

Sylvamo

The company is “facing some difficult industry conditions,” said CEO Jean-Michel Ribiéras during Sylvamo’s Q2 earnings call on Aug. 8.

It had $15 million in net income, compared with $83 million a year ago. Second-quarter net sales were $794 million, down 14.9% year over year.

Sylvamo experienced sluggish demand in Europe during the quarter, with an 8% year-over-year decrease. Industry production capacity there also has fallen by 7%, executives said. Likewise, Latin American demand decreased, by about 2%.

But North American demand was “stable year-over-year, driven by higher imports, which were up nearly 40%,” said CFO Don Devlin. That was mostly caused by buy-ups ahead of tariff implementation, and “we believe that real demand will be down 3% to 4% this year” for North America, he explained.

With imports ticking down and competitors closing mills, such as Pixelle’s in Chillicothe, Ohio, this summer and International Paper’s in Georgetown, South Carolina, last year, executives expect Sylvamo’s operating rates to improve in the second half of the year — “probably to be in the mid-90s,” said COO John Sims.

Tariffs have particularly hit the pulp industry, confirmed Sims. This primarily stems from weak demand from China, a country that the pulp market heavily relies on.

Sylvamo is investing a total of $145 million in its flagship paper mill in Eastover, South Carolina, from this year through 2027.

In the coming months, the company is working to execute a smooth transition plan for multiple executives, Ribiéras said. As previously announced, he will retire at the end of this year, prompting a C-suite shuffle that includes bumping Sims to the top spot.