Tariffs are looming large across manufacturing, and they appear to be affecting sentiment about paper and packaging demand, analysts say. Industry participants also are expressing concerns about the possibility of an economic downturn in the coming months.

While first-quarter demand data will be released next week by two leading groups that track it, the American Forest & Paper Association and the Fibre Box Association, several paper and packaging analysts released reports this week based on sentiments they learned from polling sources. Overall, they don’t paint a rosy picture.

“Our sentiment comparisons have deteriorated from positive outlooks to more balanced,” BofA Securities analysts wrote in the latest edition of their box survey report, released Wednesday, based on responses it gathered from 21 corrugated box converters from March 17 to April 11. It’s the first full-scale box survey that BofA has conducted since April 2024, although it sent some partial box surveys in the interim, including in January 2025 and November 2024.

One notable change is in the current responses regarding demand relative to demand three months ago. When asked during the most recent survey, 48% of respondents said demand is worse than three months ago. That’s up from 8% during the January partial survey and zero during the November partial survey. The proportion of respondents reporting that demand stayed the same dropped from 58% in January to 33% in March.

Nearly half of survey respondents say current demand is worse than three months ago, up from 0% in November 2024

For the coming year, respondents anticipate demand will be in neutral or worse territory: About 45% expect it to remain the same and 30% expect it to worsen. That has shifted dramatically from the January survey, when 50% of respondents expected better demand and 50% expected no change.

Respondents expect growth of 0.5% for the next two quarters, which is down from expectations for a 1.1% growth rate during the January survey. It’s also below the average growth rate expectation of 1.6% that respondents have reported since the Great Recession.

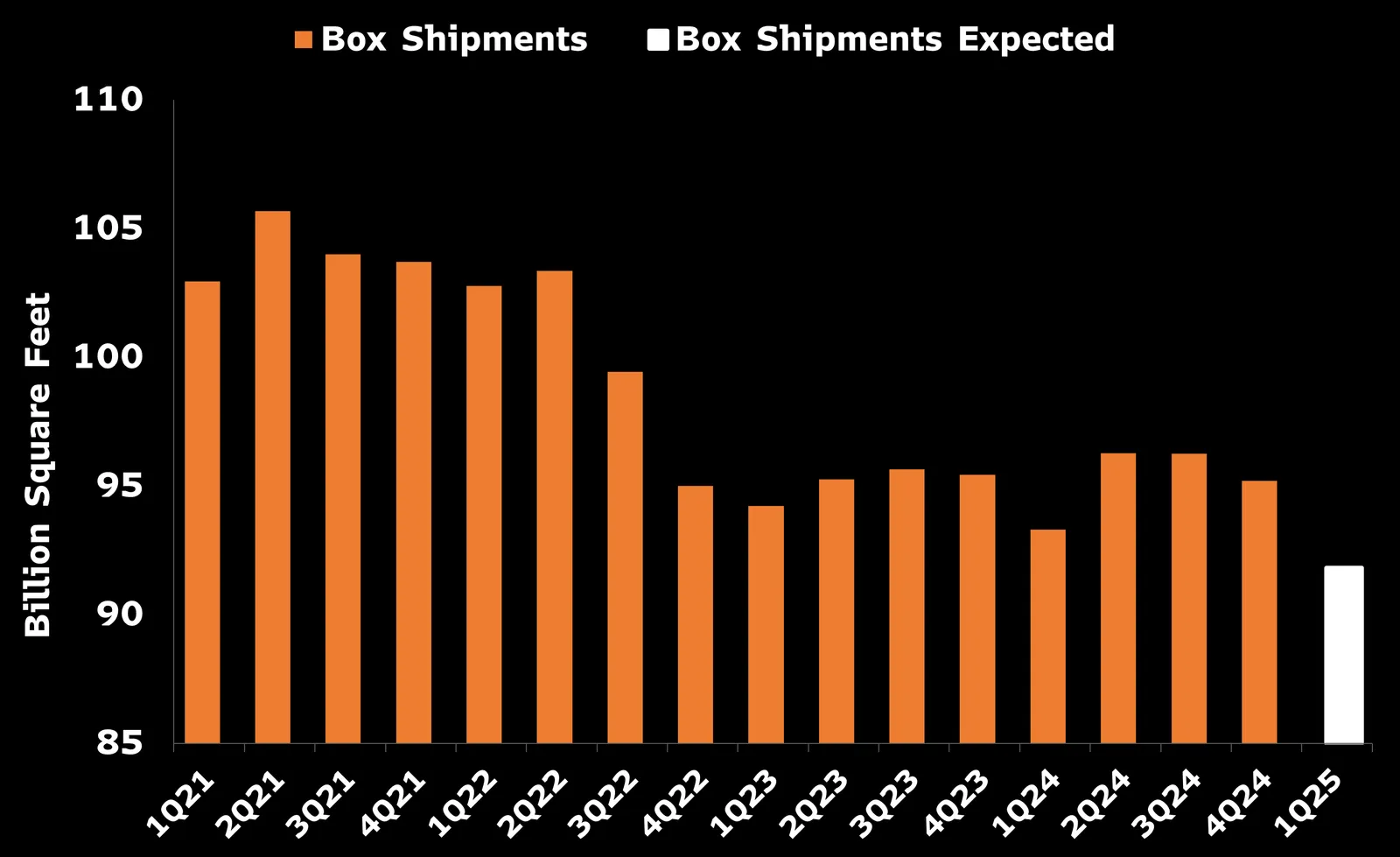

A similarly anemic demand outlook comes from a Bloomberg Intelligence report released Tuesday, based on sentiments it gathered from sources and Numera Analytics data. It suggests corrugated box shipments fell 1.6% year over year during the first quarter, and it projects a full-year drop between 1% and 1.5%. Based on a survey in December, Bloomberg Intelligence previously had projected a likely demand increase of 0.5% to 1% for 2025.

The Q1 dip correlates with the wave of tariffs that the Trump administration announced, which “have disrupted trade patterns and introduced uncertainty in both the domestic and export markets,” the April report says.

In December, “it did feel like there was so much optimism behind it, and so many people rallying behind the new administration. It really did feel like we could start to see things turn in a good direction,” said Ryan Fox, corrugated packaging market analyst at Bloomberg Intelligence. At that time, the “worst case scenario” was a possible 1.5% decline, but now that has become the probable scenario, he said.

“It is pretty resounding, this uncertainty,” Fox said. “People are kind of freezing because they don't know what to do. And in some cases, their end markets — like if they were in Canada — may have dried up.”

Some demand shifts have been caused by customers attempting to stock up prior to tariffs and then slowing orders in recent weeks, according to a Truist Securities note to investors on March 23. Certain coated recycled board producers reported a slowdown in February and March after customers built up their inventories in January in a bid to avoid expected tariffs, it said.

Although an industrial slowdown has persisted for the last 28 months, “tariffs could be the proverbial ‘straw that broke the camel’s back,’ ultimately dragging the economy into a broader recession,” Truist Securities analysts wrote in a report Wednesday. The report adds that tariffs and recession fears have driven recent downward stock performance, and paper and packaging companies’ performance is at risk if a recession materializes.

The report mentions sources’ heightened recession fears following the economic uncertainty that tariffs are causing. “Our analysis assumes that demand growth moderates in 2Q before a recession begins in 2H,” Michael Roxland, Truist Securities senior paper and packaging analyst, said via email.

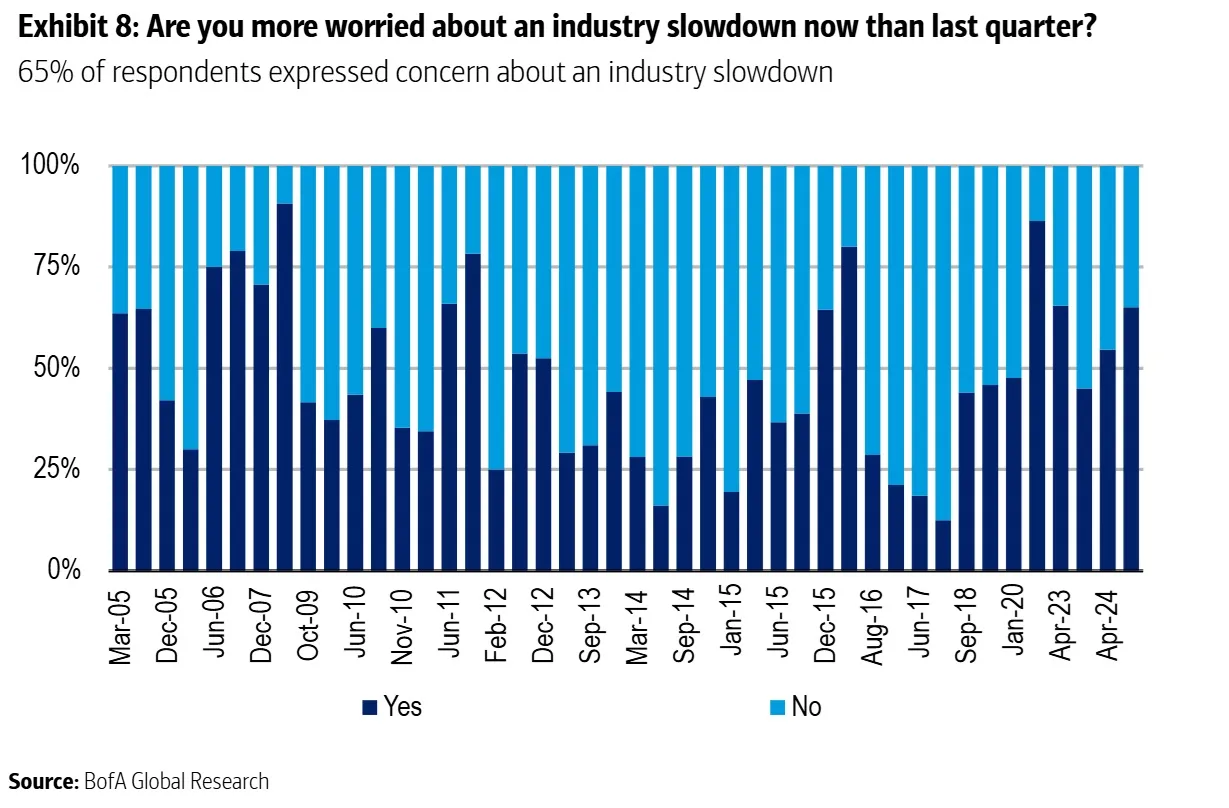

About 65% of respondents to the most recent BofA box survey also are worried about an industry slowdown, approaching levels of concern charted during the COVID-19 pandemic and the Great Recession.

A separate group of BofA Securities analysts sent a note to investors on Monday that stated economic uncertainty “spiked to levels near COVID-era highs” in March, citing data from the Economic Policy Uncertainty Index. “We believe that high levels of economic uncertainty could provide a drag on manufacturing demand in 2Q25 and beyond,” the note says.

Those BofA analysts further discussed the potential for a recession based on historical evaluations of multi-industrial stocks. During the last five recessions, stocks fell 22% from peak levels an average of 82 trading days after their peak. Currently, these multi-industrial stocks are down 19% from their Jan. 23 peak.

“It's hard to imagine that things are going to get much worse. But if we don't see the normal sequential uptick in box demand in the second quarter, I think it's going to be very difficult for people to not use that ‘r-word’ more,” said Bloomberg’s Fox.

Roxland explained that a recession now might not manifest in the same ways as previous ones. As they stand today, most of the companies Truist covers are “different than they were just a few years ago and vastly different from one to two decades ago,” he said. Paper and packaging companies’ portfolios and product mixes have changed, leverage is lower and geographical footprints and country-specific overexposure risks have changed, to name a few factors.

Prices heightened by tariffs are likely to further dampen consumer purchasing, leading to weaker demand for paper packaging, according to Roxland. That could push down paper prices and prompt producers to take economic downtime to minimize further price degradation. In previous slowdowns, containerboard prices declined by an average of $50 per ton and boxboard prices declined approximately $30 to 70 per ton, he said.

Multiple analysts point to International Paper and Smurfit Westrock as having some of the highest risk from tariffs among major containerboard producers due to their greater exposure to international trade, including in Mexico and Latin America. Tariffs and an economic slowdown could result in more downtime or facility closures, they said.

Analysts also cited IP’s projection for sluggish demand that executives mentioned during the company’s investor day in March. They anticipate that among the majors, Packaging Corporation of America would fare best due to its entire footprint falling within the United States, among other business strategies.

On the China front, “some data in our report shows a pretty pronounced pull-off of Chinese exports” in March, Fox said. Bloomberg anticipates that trade will continue to dry up.

“There are plenty of other countries that make kraft linerboard, and some of them are likely willing to sell into China,” he said. “I don't see them overcoming that huge tariff that they're facing.”