Postconsumer recycled content that can be used in new food and beverage packaging still faces obstacles to widespread use. Companies like Nova Chemicals and Atlantic Packaging are trying to leverage B2B closed loops to increase supply.

Some states have also passed laws mandating minimum levels of recycled content in certain types of packaging.

There’s also some evidence that the shift to more PCR use could win brands favor with customers. In a recent Nova Chemicals consumer insight survey, three-quarters of respondents agreed that companies ought to increase their use of packaging made from recycled materials.

But there are barriers to achieving this ubiquity, and industry participants lament imbalances in the recycled plastics economy.

“One of the issues that I see is a real disconnect between supply and demand,” said Crystal Bayliss, who leads the PCR workstream at the U.S. Plastics Pact. She said that procurement teams need to think about the long term, working with converters to establish a supply of the PCR grades they need.

It’s a pressing issue: A recent study by Closed Loop Partners highlights an increasing demand for food-grade polypropylene, citing infrastructure challenges as a key barrier to increasing supply.

Today, food-grade PCR is most often found in the form of recycled PET in soda and water bottles. Many companies include recycled content targets among their voluntary packaging sustainability goals, though progress toward those goals has varied.

A recent report from Smithers noted that 1.2 million metric tons of food-grade PCR was used for packaging in 2024. That’s up 9% from 2019 and “driven by strong demand in end-use sectors such as food and drinks, as well as greater emphasis on the use of recycled material in the manufacture of plastics packaging,” the report said.

And a 2023 McKinsey & Co. report said that “if brands with public recycled-content commitments follow through on their plans, the U.S. demand for recycled polyethylene terephthalate (rPET) in 2030 would outpace supply by about three times.”

PCR logistics

While some companies have since adjusted their plastics goals, major increases in recycled content use remain on many of their road maps.

Some of the hangup comes from issues with initial packaging design. Stabilizing PCR streams starts with boosting the amount of material that can be successfully recycled. For example, opaque colored bottles are harder to recycle. Avoiding potential contaminants also is important when the goal is to recycle packaging into a new product.

“We need to make sure that we’re not unintentionally contaminating the waste stream by doing things like putting a paper label onto a plastic film,” said Stewart Whitmire, senior manager at Atlantic Packaging.

Sources say that collection remains one of the major barriers to increasing the quality and quantity of food-grade PCR. They also say more investment and control in the recycling value chain is needed, as well as changes to consumer habits and recycling availability.

“Even though collection is going up, it’s not going up enough,” said Srinivasan Prabhushankar, technical director at the National Association for PET Container Resources. “What we really need is the velocity and scale.”

For now, PCR is typically more costly than virgin plastic. As of January this year, Platts data showed price spreads between recycled and virgin materials are close to their highest recorded values since 2022. For procurement teams that are used to buying virgin materials, it’s a learning exercise.

“When you’re talking about virgin materials, you can get the same thing every time, for the agreed upon price, for the stated term,” said Emily Tipaldo, program manager at the Association of Plastic Recyclers.

Reiterating a longstanding industry concern, Tipaldo said there’s a chicken-and-egg problem: low availability of PCR feedstock can drive up prices, but recyclers and reclaimers ultimately need long-term assurance of demand. “Without that … they really can’t make those investments and likely won’t be able to deliver exactly what the client or customer wants,” Tipaldo said.

PCR can differ from virgin materials in terms of texture and color, potentially posing concerns for brands who want complete consistency in the aesthetics of their packaging.

Longer-term contracts can help ensure more consistency over time. But, Tipaldo pointed out, they are often not watertight. And when companies walk away from PCR contracts due to importing resins from abroad or opting for virgin materials at lower prices, that can stifle reclaimers’ progress.

Tipaldo said some companies may not continue business due to the size of the contracts that were abandoned. She noted that when North American reclaimers cite "economic conditions" as a reason for cutting capacity, not moving forward with upgrades, or pulling out of certain markets it often has to do with losing contracts. This can happen, she said, “because of prices compared to virgin or ‘off-spec’ resins, or due to recycled plastic imports undercutting [North American] PCR."

Bayliss echoed the need for long-term contracts, “so that reclaimers can install the equipment that is needed to produce those higher quality grades of PCR.”

Looking ahead

The U.S. Food and Drug Administration released new guidance in 2021 on the use of recycled plastics in food packaging, but more momentum is happening at the state level due to certain laws requiring PCR.

For example, Washington state will require that most types of plastic beverage containers have no less than 25% postconsumer recycled plastic content by weight by 2026. And in California, requirements to use PCR are ramping up over time: Between 2025 and 2029, many plastic beverage containers will have to contain at least 25% PCR, on average; by 2030, the requirement will be 50%.

But using more PCR is just one lever that brands can pull in their mission to use less virgin plastic. Another, Whitmire pointed out, is lightweighting and downgauging. For some brands, this might be a more viable option.

“All PCR is not created equal at the moment,” he said. “[It] has to be of a quality that you’re not sacrificing performance of the structure.”

If the PCR doesn’t meet specific performance criteria, then this could potentially lead to using more plastic. The goal, Whitmire said, is to find instances where virgin plastic can be replaced with PCR one-for-one.

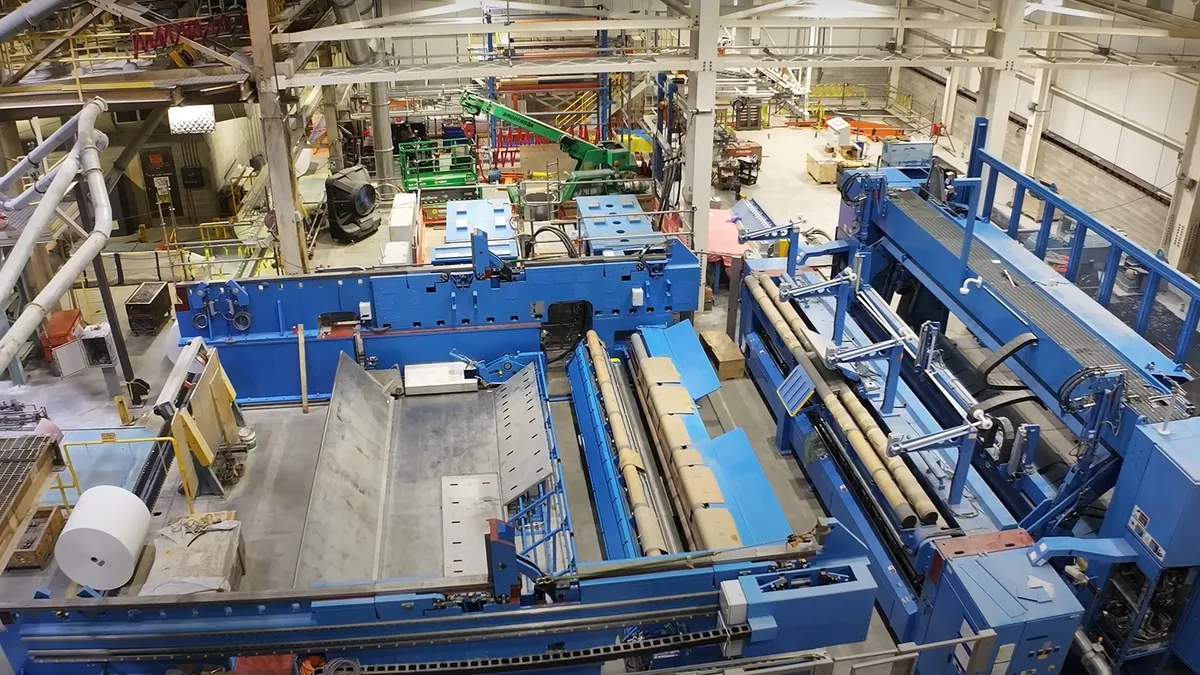

Closed loops and B2B sourcing are seen as one way to generate more high-quality PCR. Nova Circular Solutions, a business unit formed in 2023, started up a new Indiana facility in January that will focus on processing films collected from retail and distribution centers into pellets.

“What’s key is the traceability, and the security of supply of the feedstock,” said Vice President Greg DeKunder.

Once at full scale in 2026, the facility is expected to offer more than 110 million pounds of recycled polyethylene to the market annually, with two of the four lines designed for food-grade PCR.

This follows Nova Chemicals announcing in June that it received a letter of no objection from the FDA for its Syndigo product, confirming the capability of the recycling process to produce linear, low-density polyethylene suitable for broad food-contact applications. Helping customers to design the packaging and shoring up supply is a key focus, said DeKunder, adding that “it’s not going to be here today, gone tomorrow.”

In the push for incorporating more PCR and preparing for state regulation, Bayliss suggested that companies need to make sure their cross-functional teams are all on the same page.

“Oftentimes, these things run through the sustainability department, possibly the packaging department. But it also needs to run through the procurement department,” she said. Companies need to understand requirements “and then [put] their procurement managers to work to build that industry capacity.”