- Business commentary: Greif executives discussed a challenging demand environment in the quarter that ended July 31 during an earnings call Thursday. The global industrial packaging business saw 20% volume headwinds in the Americas and 10% in Europe, the Middle East, Africa and the Asia-Pacific regions, said CEO Ole Rosgaard. In discussing a $146 million year-over-year sales decline in paper and packaging services, Rosgaard pointed to demand weakness across converting businesses and mills. Greif took approximately 55,000 tons of economic downtime across its mill system during the quarter “as we face nearly 10% per day volume declines across primary converting operations,” Rosgaard said. He said that “continued low-volume environments” along with rising OCC costs impacted earnings before interest, taxes, depreciation and amortization during the quarter.

- Recession commentary: CFO Larry Hilsheimer reflected on the guidance the company had shared for 2023, which projected adjusted EBITDA between $820 million and $906 million and adjusted free cash flow between $410 million and $460 million. “I'll be frank with everyone. While we considered at the time the possibility of an expanded slow demand cycle, we did not weight that heavily, as doing so would imply we felt that we were headed into another industrial recession,” Hilsheimer said, adding that that initial assumption was clearly incorrect. “While we may not be in a broad economic recession, global manufacturing PMI has remained below 50,” which is a sign of contraction, for nearly a year. “And our year-to-date volumes across [global industrial packaging and paper packaging and services] are both tracking down mid-to-high teens year to date. If that's not indicative of an industrial recession then I'm not sure what is,” Hilsheimer said.

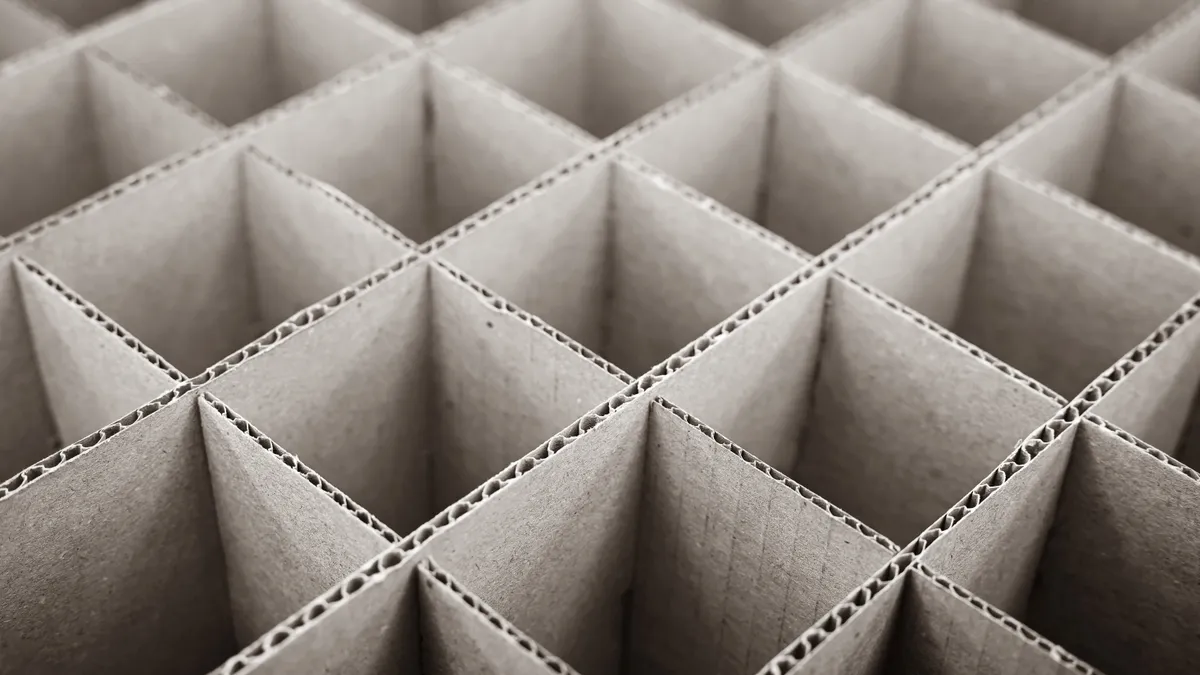

- Expanding in paper partitions: Greif announced in conjunction with its earnings release that it acquired a 51% ownership interest in ColePak, which Rosgaard described as the second-leading supplier of bulk and specialty partitions in North America, which are often used to protect fragile contents such as glass bottles. Those partitions are made from both uncoated recycled paperboard and containerboard to serve food and beverage markets. ColePak has facilities in Ohio and California. This deal adds an entirely new product offering to Greif’s paper converting portfolio, the company said. “This business is immediately margin accretive to the global Greif portfolio and is expected to contribute EBITDA before synergies of $15 to $20 million per year,” Rosgaard said Thursday. Financial results will be reported within the paper packaging and services segment starting in fiscal Q4. Regarding other recent acquisitions, Greif said that net sales from Lee Container and Centurion Container’s primary products will be reflected in the global industrial packaging segment starting in Q1 and Q2 of fiscal year 2024, respectively.

- Outlook: The company’s guidance for fiscal year 2023 results now stands at adjusted EBITDA between $790 million and $820 million and adjusted free cash flow between $400 million and $430 million.

Greif executives discuss downtime at mills, signs of industrial recession

The industrial packaging and paper company also announced it’s acquired a majority interest in ColePak, which it described as North America’s second-leading supplier of bulk and specialty partitions.