- Economic outlook: O-I Glass’s Q1 “significantly exceeded prior year results as well as guidance,” and adjusted earnings per share represented “record first-quarter results,” CEO Andres Lopez told investors during an earnings call Wednesday. That performance beat came despite lower volumes in some areas. The company expects sales volumes will be down across 2023, Lopez said. Supply chain destocking is dampening underlying demand, according to Lopez.

- Americas and Europe businesses: Net sales in the Americas increased more than 6% to $1 billion, amid higher selling prices, even as volume was down about 5%. The company did note that it was a challenging prior-year comparison, given that Q1 2022 represented recovery from global supply chain challenges. Likewise, net sales in Europe rose 13% to $799 million, against a 12% decline in glass container shipments. The company stated in its quarterly report that beer bottle demand was softer in North Central Europe and “the region remains oversold in the wine category across Southern Europe.”

- Impacts to shipments: O-I cited strikes in France, civil unrest in Peru and flooding in Northern California as contributors to Q1 volume declines. Customer destocking and softer consumer demand in some markets were also factors. “These trends were most notable across the mainstream beer, food and [non-alcoholic beverage] categories in North Central Europe and Mexico,” Lopez said. “While there are many moving pieces here, we believe underlying demand was down about 2% to 3% during the first quarter.”

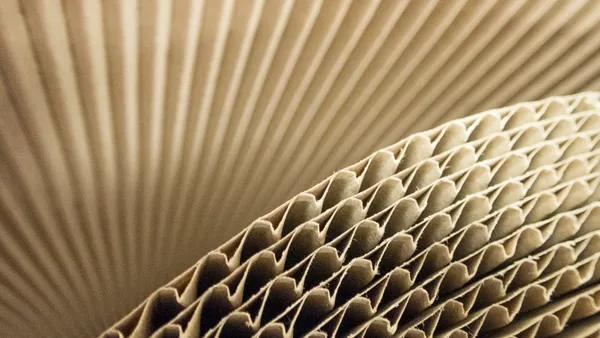

- Manufacturing enhancements: O-I said it’s forging ahead with its modular advanced glass manufacturing asset, or MAGMA, technology. It recently broke ground on a new production facility in Kentucky. Lopez also noted that O-I recently completed in France “a sizable investment at our beer plant that will significantly reduce our CO2 emissions.”

- Looking ahead: In the second quarter, the company expects adjusted EPS to increase from last year but decline sequentially from Q1. CFO John Haudrich said Q2 results will likely benefit from favorable net price, although sales volumes are expected to be down. Operating costs will also increase as O-I commissions new capacity. O-I raised its full-year guidance; still, Haudrich said the company’s outlook is “intentionally conservative” amid “elevated macroeconomic uncertainty,” particularly in the back half of 2023. The company intends to “provide regular updates on our business outlook” especially as volume and working capital levels become clearer, Haudrich said.

O-I Glass sees lower volumes in Q1 but raises 2023 earnings guidance

Higher selling prices helped overcome year-over-year sales volume declines, which O-I attributed in part to disruptive events, customer destocking and softer consumer demand in some areas.

Recommended Reading

- How packaging manufacturers fared in Q1 By Packaging Dive Staff • Updated May 10, 2023

- O-I advances plant with latest glass production tech By Maria Rachal • April 18, 2023