Greif completed the divestiture of its containerboard business to Packaging Corporation of America for $1.8 billion in cash, the companies announced after markets closed Tuesday afternoon. The transaction itself closed on Sunday, according to a securities filing.

“The closing of this sale marks an important step forward for Greif,” Greif President and CEO Ole Rosgaard said in a statement. “This transaction unlocks immediate value for our shareholders and allows Greif to deliver stronger and more consistent earnings power, enhances our capital efficiency, and accelerates debt reduction.”

The company plans to use proceeds from the sale to pay down approximately $1.4 billion in debt, according to another securities filing.

After the deal close, Greif altered its 2025 full-year guidance to $507 million to $517 million of adjusted earnings before interest, taxes, depreciation and amortization for fiscal year 2025, which ends Sept. 30. The company also altered its adjusted free cash flow guidance for 2025 by about $15 million, to a range of $290 million to $300 million, inclusive of discontinued operations.

Greif previously reported results for the containerboard business in its paper segment, but it now will classify that as a “discontinued operation” beginning in the third quarter of 2025. The company announced in a 2024 securities filing that in 2025 it would change its fiscal year end from Oct. 31 to Sept. 30, resulting in an 11-month fiscal year for 2025.

PCA anticipated it will fully realize pre-tax benefits of approximately $60 million within two years after the deal closes.

The companies announced on July 1 that they had entered an agreement the previous day for a $1.8 billion cash transaction. They initially projected the deal would close by the end of the third quarter of the calendar year. Rosgaard announced on the company’s earnings call last week that the closing would occur by the end of August.

The divestiture supports Greif’s recently launched three-year, $100 million cost-cutting plan and its work to refocus its priority markets.

“Our strategy has been, and is, that we want to have a No. 1 or No. 2 position in whatever we choose to do,” Rosgaard said on a July 1 call to discuss the divestiture. “We are not there with containerboard. We aren’t even close. And we are unwilling to make the significant investments that that would take.”

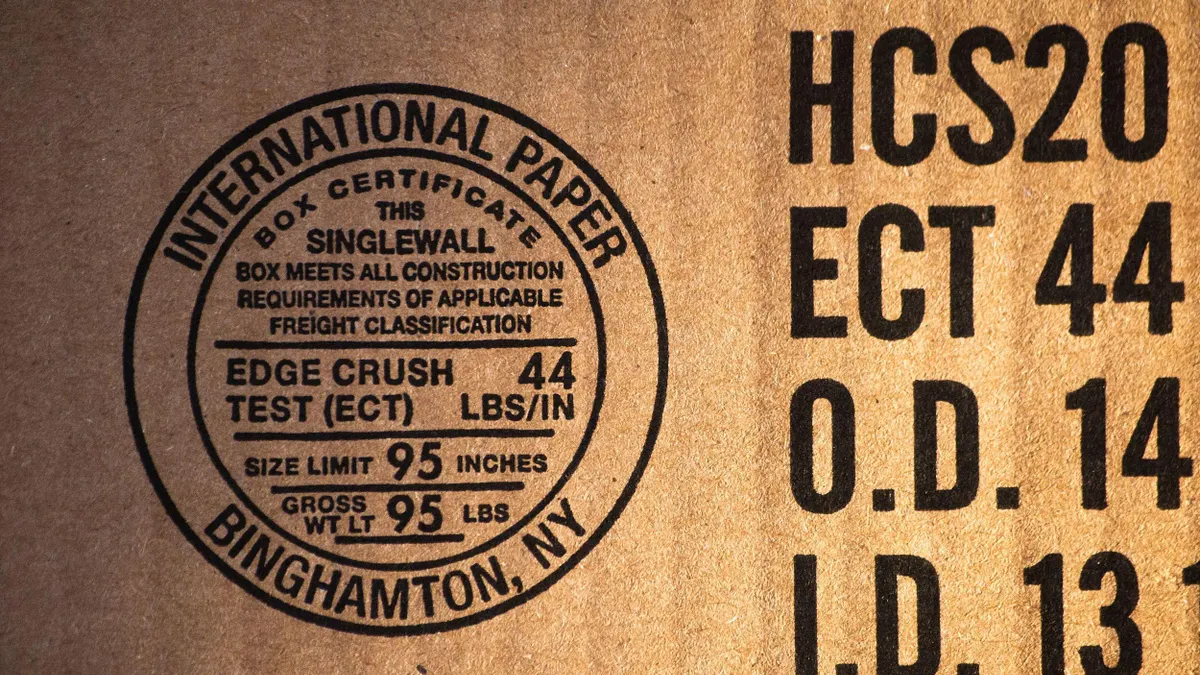

PCA’s executives have also detailed the benefits they expect from the deal. “It is a well-capitalized business that complements us nicely, and it will provide us with a very good growth platform for both containerboard and corrugated products,” said PCA CEO Mark Kowlzan during the company’s July 24 earnings call.

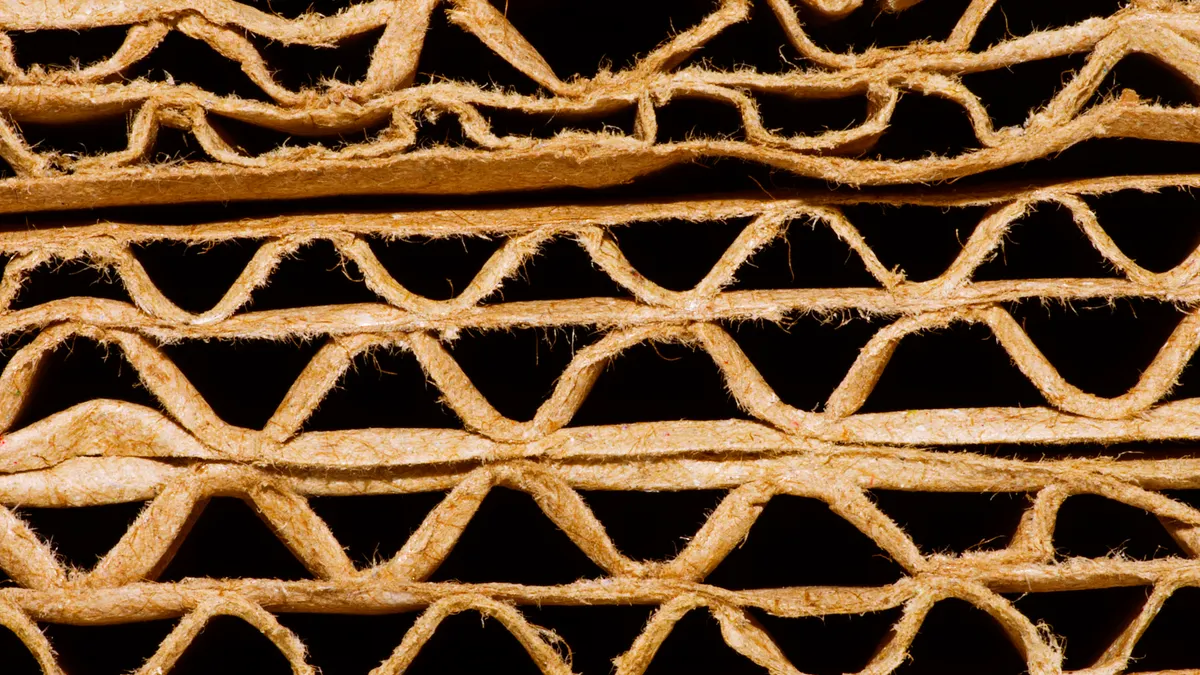

PCA says it’s the third-largest containerboard producer in the U.S. The Greif acquisition will add two mills — the Riverville mill in Amherst, Virginia, and another mill in Massillon, Ohio — with a combined 800,000 tons of production capacity per year. The deal also includes eight sheet feeder and corrugated plants across the country.

Some Greif assets PCA acquired in the deal overlap with geographic areas that PCA already had been exploring, Kowlzan said, citing areas including Texas. “We’d already been looking at what we would be doing down in the Dallas region, which would have entailed, more than likely, building out a new, very large plant down there, including for producing recycled products,” he said. But the synergies the acquisition will create in Texas and other markets will enable growth with a lower level of capital spending, he said.

PCA CFO Tom Hassfurther said on the earnings call that this capital avoidance is important because “the capital intensity in this business is tremendous. What used to be [our] being able to put a box plant together for $100 million is now closer to $300 million. And a mill used to be $300 million on the cheap, and now it's going to cost you every bit of $1 billion.”

The synergies also will boost PCA’s recycled products capabilities, PCA executives said, noting that the Massillon mill, which manufactures 100% recycled products, can swing between linerboard and corrugating medium. PCA’s Ashland and Newark full-line plants in Ohio are close to the acquired Massillon mill, so the company will be able to shuttle product among them, Kowlzan said. PCA’s recycled mix has historically been around 20% of its portfolio, and the acquisition will bump that up to roughly 30%, he explained.