Major bottle and can manufacturers offered a window into consumer and beverage market trends they’re watching in 2025 as they reported 2024 earnings results. These were some of the key beverage topics companies discussed on recent investor calls.

Ball talks portfolio diversity

Ball reported that its global beverage can shipments were down year over year in the fourth quarter, but up 1% across 2024.

Addressing the first quarter of 2025, Ball noted Dry January, when consumers avoid alcohol in the first month of the year, as a seasonal headwind for the beer business. But the Super Bowl and upcoming spring break season provide a lift.

Still, Ball’s reach goes beyond beer, especially as its beverage customers of all kinds diversify their portfolios. For one, Ball said it saw growth in January in the energy drinks segment.

Innovations by both large customers and independent brands are having an impact. “The Poppis of the world, the Liquid Deaths ... they're large in our portfolio,” said CEO Dan Fisher on a Feb. 4 earnings call. Still, if Ball’s large customers — which include the likes of Coca-Cola and Anheuser-Busch — are not growing, “you can have all of the startups in the world, and you're just not going to move the needle on the size of volume. So there's definitely a balance.”

Fisher also said, “the folks that have struck a nice balance between being a beverage company and being a beer company, those are the ones that I believe will win medium and long term.”

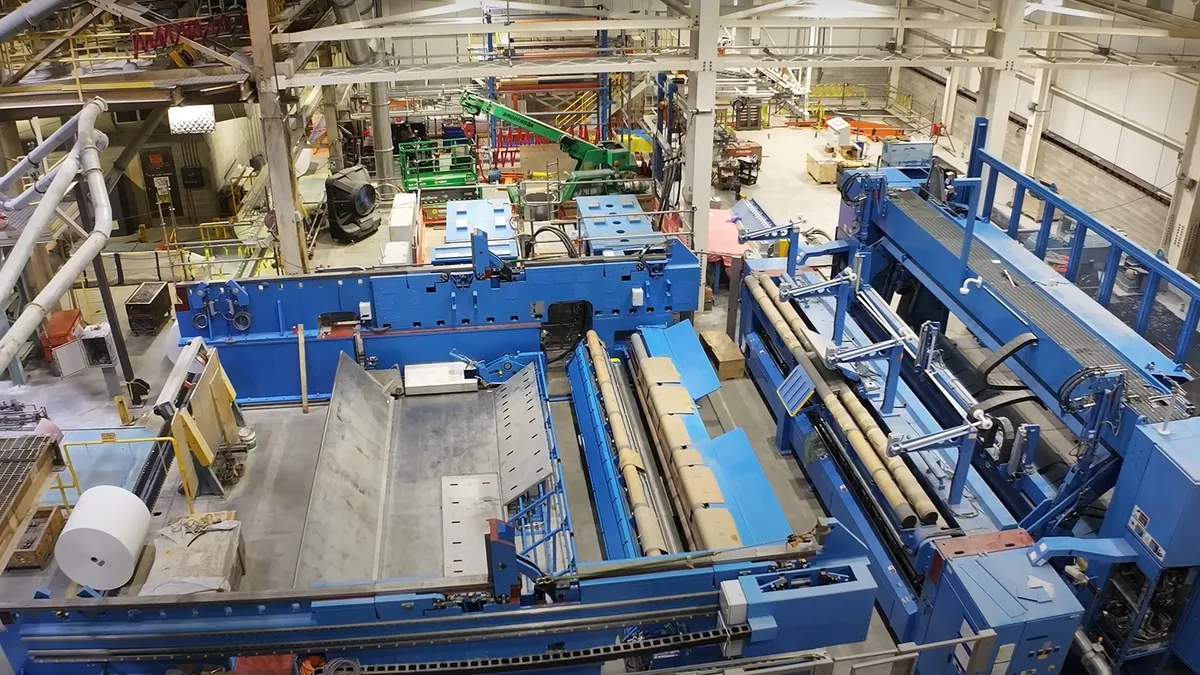

During its earnings call Ball also announced it’s expanding its beverage can manufacturing capacity in Florida.

Crown Holdings watches consumer strength

Crown saw a 4% increase in global beverage can volumes during Q4. Looking at the full year, sales grew nearly 2% in its Americas Beverage segment — and nearly 7% in its European Beverage segment. “We continue to see the conversion to the aluminum can as the package of choice for beverages in Europe, and we expect 2025 to be another record year of earnings on the back of strong demand,” said CEO Tim Donahue on a Feb. 6 earnings call.

But the company is cautious about the strength of end consumers, particularly in its North American and Asian markets. One factor that Crown noted at one point is that consumers could feel inflationary impacts resulting from tariffs.

Speaking broadly, “we have modeled North American volume to be flat,” in 2025, noted Donahue. “So we are not stepping out on a ledge assuming the consumer is going to be exceptionally strong.”

O-I Glass wants to be a stiffer competitor to cans

In its earnings report, O-I blamed “sluggish market demand and macro conditions” for a challenging 2024. Sales volumes were down 4% year over year.

Alcoholic beverages comprise about three-quarters of O-I’s portfolio, with non-alcoholic beverages and food markets making up the rest. Currently, demand and performance appear to be split geographically. “Really, it's a story of two hemispheres: growth in the Americas and then sluggish to slight decline in Europe,” due to different consumer and pricing factors, explained CEO Gordon Hardie on a Feb. 5 earnings call.

Executives also discussed glass competing with cans in the beverage space.

“We have a clear drive to get much more competitive with cans,” said Hardie, who took over as CEO last year. He said that in the past decade, O-I hasn’t been competitive enough and most of the “solid growth” in food and beverage packaging has gone to cans. He said O-I analysis indicates that when glass gets to within about 15% of the cost of cans, “you see a quite measurable flow from cans back into glass.”

“So armed with that knowledge, we're taking the business forward with a view to getting competitive with cans in any market in which we compete with cans,” Hardie said.

One near-term growth opportunity is in 12-ounce glass containers of ready-to-drink cocktails. U.S. regulators recently decided to allow spirits in that packaging format.

“We see opportunities there for glass to penetrate RTDs in a way it never did over the last 20 years,” said Hardie. “So I think where we're focused on is getting competitive, not just with other glass competitors, but getting more competitive with cans overall.”

O-I also remains cautious about the health of the end consumer this year.

“As we enter 2025, we continue to maintain a cautious commercial outlook. There is still some way to go to align consumer real income with the inflation experienced over the past few years and to see destocking moderate across the value chain to pre-COVID levels, particularly in the spirits category,” said Hardie.