Packaging professionals have to think outside the box as customers, investors and regulators are demanding leaner, cleaner, smarter and more sustainable options to market and protect products.

It’s only been a few years since the pandemic pushed e-commerce to new heights, and since then, changing consumer patterns and record-high inflation have struck blows to product demand and packaging manufacturers’ earnings. Further effects are anticipated from forthcoming government requirements about what packaging is made of and how its disposal — or reuse — is managed.

Manufacturers and converters are striving to get ahead in this environment by employing innovative design, consolidating operations, and experimenting with new collaboration up and down the value chain.

As legislative sessions and fiscal calendars progress this year, and target years for ESG goals draw closer, these are just a few of the notable industry trends the Packaging Dive team is keeping an eye on. What else are you watching? We’d love to hear from you at [email protected].

Packaging companies continue to navigate an uncertain inflationary environment

Whether and when inflation will be brought under control in 2023 is a pressing question for packaging companies seeking some stability in an uncertain economy. The Producer Price Index and other key indicators suggested an easing of inflationary pressures in February. That trajectory could reverse the reduced consumer demand and customer destocking that plagued the industry over the past year and tamped down earnings.

Industry growth is still expected this year and through 2025, but it may slow during that time, according to a recent report from the Association for Packaging and Processing Technologies and AMERIPEN. The 500 billion units of packaging sold in the U.S. during 2021 are expected to reach 532 billion in 2025, but the 1.7% compound annual growth rate from 2022 is expected to cool to 1.5%.

Even as glimmers of hope are emerging that the federal government’s efforts are beginning to tame inflation, the process is slow and dampening effects are still anticipated at least through Q2 — and it is contingent upon avoiding an all-out recession. Packaging companies are predicted to experience flat to low-single-digit volume growth this year, which would be weighted toward H2, according to Adam Samuelson, a vice president at Goldman Sachs whose industry coverage focuses heavily on packaging materials for consumer packaged goods, including flexible and rigid plastic, boxboard and beverage cans.

Different packaging sectors have been affected to varying degrees by inflation and the post-pandemic shift in consumer purchasing from goods to services, with a divergence evident between consumer and industrial segments.

"Protective packaging has been the area where the volumes have been challenged over the course of the past six to nine months — that's where destocking has had the most significant impact," Samuelson said. "We're not expecting a robust rebound in activity in those areas."

On the flip side, certain CPG items, like food and beverage staples, typically have demand elasticity even during challenging economic periods, he said. Some slowdowns have occurred because brands passed inflation-related costs down to consumers, which could reverse if brands drop prices back down this year, but that is not expected. Samuelson said forecasts suggest that "generally, incremental pricing actions from here are going to be a lot more modest" now that sharp cost increases related to inputs like materials and freight/logistics have eased.

But executives and analysts caution that it will take more time to get inflation in check and unleash a positive impact on packaging demand. "Given what we've seen in February, relative to volume trends in December and January, there's certainly no indication to us that anything has shifted yet," said Greif CFO Larry Hilsheimer during a recent earnings call.

Manufacturers pursue automation opportunities

Despite economic uncertainty, packaging manufacturers don’t necessarily plan to cease investments in automation this year, especially in resilient areas like food and beverage that are less economically sensitive, Samuelson said: "You see a steady momentum in terms of capital spending in those areas that tend to be less volatile."

Capital expenditure reductions would most likely occur in protective packaging and other industrial areas that are more economically sensitive. "Some areas of that aren't quite as strong as you see that market recalibrate off the COVID highs," Samuelson said. Still, companies continue to announce new or upgraded "state-of-the art" facilities that house modern, more efficient technologies.

Automation provides manufacturers with longer-term cost savings on several fronts, which add up — especially during periods of financial turbulence. The savings on labor costs are a "critical part" of the calculation for an automation investment, Samuelson said, but noted numerous other benefits including energy efficiency: "I wouldn't want to frame it as exclusively a labor savings."

Graphic Packaging International, for example, recently announced that it will build a $1 billion coated recycled board plant in Waco, Texas, to allow it to close older, less efficient, costlier facilities and boost manufacturing sustainability.

"It's clear to see that the modern technology inherent in these new machines provides meaningful cost to produce step-change improvement compared to the decades-old machines used elsewhere," said CEO Michael Doss during a recent earnings call.

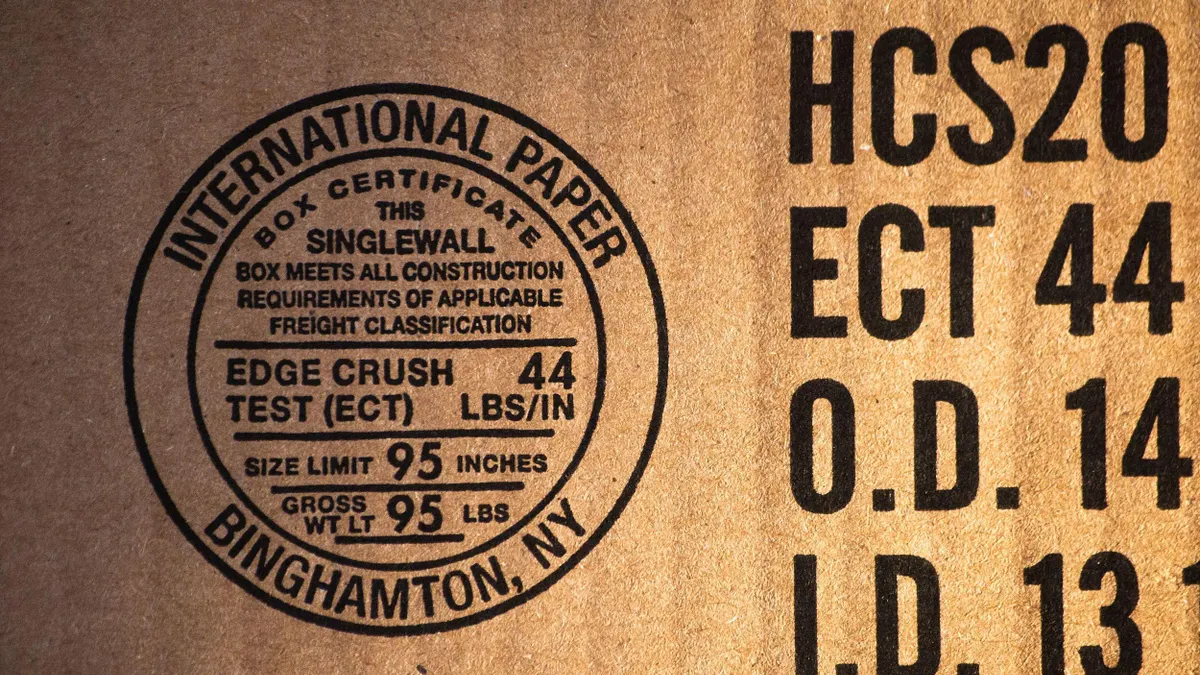

Momentum builds for materials management and marketing regulation

A wave of state legislation in the U.S. — as well as federal action and proposals abroad — could spell numerous changes coming for packaging design and management. All could put further pressure on packaging companies to help brands shift their materials, how they invest in circularity and even prompt them to focus on reusable options.

Manufacturers have yet to face extended producer responsibility for packaging in the U.S., but four states passed EPR laws in the last two years and are working toward implementation as early as 2025. While only a few of the many bills introduced gain traction (including a notable proposal in Washington that recently failed to advance), numerous states are still considering EPR for packaging during the 2023 cycle, including Maryland and New York.

As some brands set recycled content targets for their products, so too are lawmakers. Minimum recycled content requirements now exist in a handful of states, including California, New Jersey and Washington, with varying breadth. Some states have also considered including such requirements through EPR legislation.

State and federal marketing-related regulation and guidelines are also in the works. California, for example, is preparing to crack down on which packaging can feature the chasing arrows recycling logo, and in 2023 it is working on steps toward implementation. At the national level, this year the Federal Trade Commission and industry stakeholders are preparing to discuss updating the Green Guides for the first time in a decade, which steer the appropriate use of environmental marketing claims.

Overall, the diversity of bills cropping up prompts industry concerns about harmonization, or how disparate laws could create challenges with packaging design and distribution.

Packaging companies with significant operations and sales in Europe also are watching the EU, which is considering significant revisions to its packaging waste regulations that would push a shift away from single-use items. Major companies that would be affected by the pending changes, like McDonald’s, are campaigning against the timeline to adopt reusables incrementally starting in 2030.

Remaining PFAS in packaging draws scrutiny

Uncertainty about the future of where and how to regulate PFAS — or per- and polyfluoroalkyl substances, also called “forever chemicals” — will continue to raises questions this year for packaging facilities and products.

At the federal level, the U.S. EPA and FDA are taking steps to determine “safe” levels of PFAS in different settings. Last year, the Keep Food Containers Safe From PFAS Act passed the Senate as part of the FDA Safety and Landmark Advancements Act, but those provisions ultimately were not included in the House-passed Food and Drug Amendments of 2022.

It remains to be seen how new EPA action regarding PFAS in drinking water could impact facilities management, such as at paper mills. A 2022 EPA survey indicated that the remaining U.S. pulp and paper mill facilities known to be using PFAS are set to phase it out this year.

At the state level, PFAS regulation has largely targeted food packaging, with numerous bills in play this year. States laws with upcoming enforcement include Colorado, Vermont, Maryland and Minnesota. And as PFAS regulation gains steam, it could cover a wider array of additional products rather than being specific to certain types of packaging.

As is the case with other increasingly regulated aspects of operations and design, some companies have voluntarily sought to phase out PFAS from packaging in advance of any requirements passing.

“When the consumers want to know what's in the packaging, or if the regulators want to know that packaging is compliant in the future, I would say that they should just be looking to the supply chain,” said Melissa Lavoie, a project manager at the Northeast Waste Management Officials’ Association who manages the Toxics in Packaging Clearinghouse, explaining the importance of having good awareness of input materials and asking for certificates of compliance.

Plastics could be an M&A hotbed

Packaging is no stranger to M&A, fueled in recent years by generational shifts and economic pressures during the pandemic. Yet observers say it’s too soon to know whether 2023 will be a big year for activity.

"Packaging is a mature market, it's pretty heavily consolidated,” said Kyle White, a director of equity research and lead analyst on paper, packaging and environmental services at Deutsche Bank. "You're probably going to see a slowdown in deal activity right now given the market environment."

White cited economic uncertainty and higher deal costs due to rising interest rates as key factors on the minds of major companies this year. The latest round of quarterly earnings calls saw multiple companies moderate expectations for 2023 growth, with a focus on cost control and more targeted spending.

Major public companies are still doing deals, such as WestRock selling the remaining stake in its RTS Packaging joint venture to Sonoco — which is currently under review by the U.S. Department of Justice. But observers expect there could be heightened activity in the plastics space, especially among private companies or smaller players. That sector remains more fragmented than other material categories and still has a number of family-owned businesses.

Another factor that could fuel activity in packaging M&A is private equity firms, which are increasingly attracted to the space given its more steady cash flows and perceived resiliency during a recession.