Dive Brief:

- Paper cup recycling has reached a milestone, with more than 40 North American mills now accepting single-use, polyethylene-coated paper cups, the NextGen Consortium and Foodservice Packaging Institute announced Tuesday.

- Mill operators newly added to the growing list include Greif in Austell, Georgia, and Milwaukee; Newman and Co. in Philadelphia; PaperWorks Industries in Wabash, Indiana; and Resolute Forest Products in Menominee, Michigan.

- Only 11% of U.S. communities accept paper cups in their residential recycling programs. Mills play a “pivotal role” in advancing greater paper cup acceptance across the recycling value chain, NextGen and FPI said. They are working to increase the supply of recycled content to meet growing demand while reducing the material sent to disposal.

Dive Insight:

Most paper cups are used for hot beverages and contain a poly coating to prevent the product from leaking or breaking down the fiber. Poly coatings on cups and other fiber packaging items can present challenges for mills that need to separate the two elements. But equipment advances, growing recycled fiber demand and growing demand for certain fiber feedstocks amid marketplace changes are driving greater paper cup acceptance in recycling streams.

“Paper mills play a critical role in strengthening end markets for cups. By pulling materials through the system, mills accepting cups can drive increased cup processing in recycling facilities and cup collection in communities,” Kate Daly, managing director of the Center for the Circular Economy at Closed Loop Partners, said in a statement.

The NextGen Consortium is managed by the Center for the Circular Economy, the innovation arm of Closed Loop Partners. The consortium’s brand members include McDonald’s, Starbucks, the Coca-Cola Co., Pepsico, Yum! Brands, Wendy’s and JDE Peet’s.

Numerous state-of-the-art recycled fiber mills that can better handle polycoated paper cups have opened in recent years. Others mills have upgraded their equipment to handle these items. They’re more willing to do so now than in the past due to lower supplies of other feedstocks, like corrugated boxes — partially due to e-commerce lightweighting and packaging elimination — and mixed paper, said Bill Moore, president of consulting firm Moore & Associates.

Generally, paper cups are accepted in recycling programs that process residential mixed paper, but there are “actually only about 40 mills in the U.S. that can use residential mix paper,” Moore said. The mills’ main feedstock, office paper, “has been declining for 10 years and continues to decline.” So they've been looking for alternatives, he said, including fiber-based cups, plates and ice cream tubs.

During a webinar last summer, Moore said there has been a “step change” in the number of mills accepting paper cups in the last three years. That’s partly been driven by about 900,000 tons of mixed paper processing capacity being added in the U.S. from 2020 through 2025, he said — more new papermaking capacity than the U.S. had added in the previous 25 years.

“Cups have a decent yield that’s extremely high-quality fiber,” Moore said. Jeff Hilkert, vice president of paperboard sales, South, at Greif Mill Group, corroborated that point in a statement: “The mix of recovered paper we receive has changed dramatically over the last several years, now including much more plastic that we have to separate in the repulping process. Paper cups contain good fiber and are no more difficult to recycle than many of the other prominent packaging categories we see today.”

Demand for high-quality recycled fiber is only expected to grow as more brands seek to reach sustainability targets. This creates an opportunity for paper cups, of which an estimated nearly 50 billion are disposed each year in the U.S.

The current 40-plus mills accepting cups is an increase from the more than 30 mills that accepted cups as of November 2023, when the NextGen Consortium released a report with findings intended to accelerate domestic paper cup recycling. Prior to the release of the report, the group collaborated with FPI and Moore & Associates to identify more than 15 additional mills willing to test cups in their systems.

Other efforts from NextGen and FPI include educational campaigns to describe the material’s value and identifying for MRFs which mills will purchase their bales of mixed paper or polycoated cartons and aseptic packaging that include polycoated cups. Facilities owned by Cascades, Georgia-Pacific, Graphic Packaging International, Green Bay Packaging, Pratt, Sonoco and WestRock are among those on the list.

Separately, the Poly Coated Paper Alliance launched in March 2023 to encourage widespread end-market acceptance of a variety of polycoated paper packaging products. One of the initial confirmed members of that alliance is the Carton Council, another group with numerous initiatives aimed at expanding acceptance of a polycoated product: aseptic cartons.

Like the Carton Council’s approach to that product, which involved engaging stakeholders across the value chain — including for collection, MRF processing and mills — FPI and NextGen’s paper cup work took a “multipronged approach where they worked on the demand side and they worked on the collection side,” Moore said.

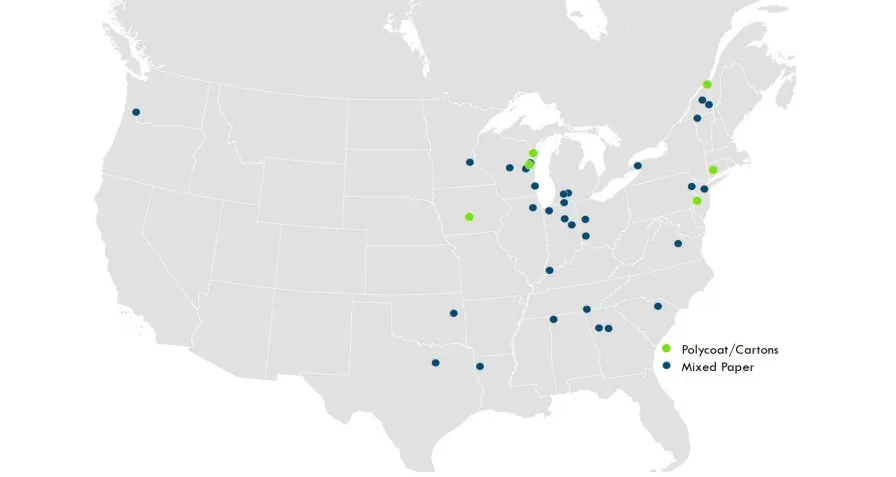

All the players involved say there’s more work to be done, however, to increase paper cup acceptance at all points along the chain. From the mill perspective, more work needs to be done on the West Coast, Moore said, highlighting the concentration of mils that accept paper cups in the eastern half of the country. “We picked up four or so mills on the West Coast, which is still not a lot — which means most of the [West Coast] cups are going to export,” Moore said.