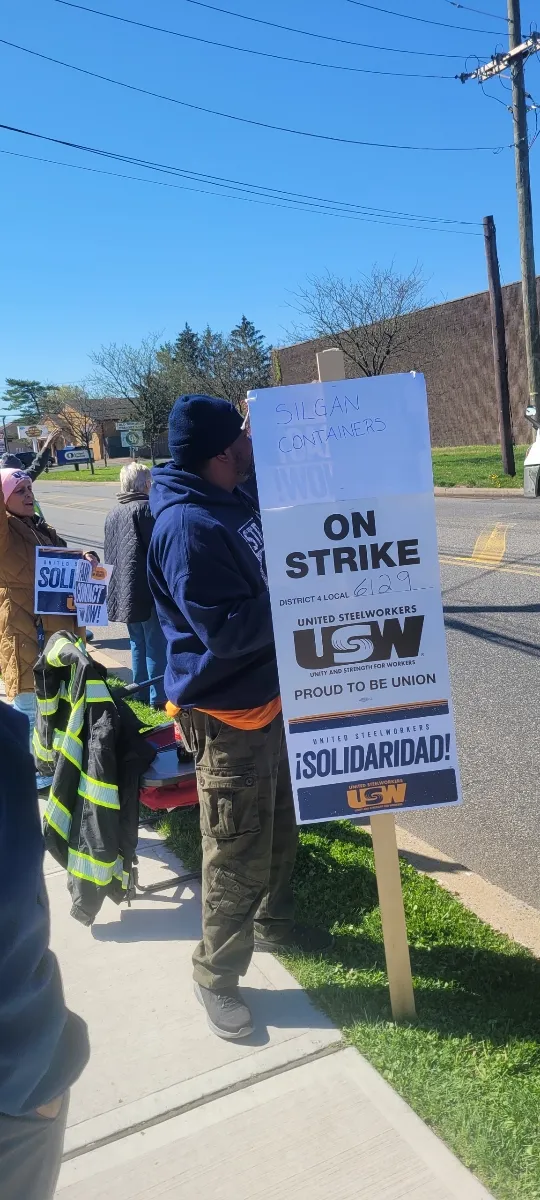

United Steelworkers-affiliated employees at a Silgan Containers plant in Edison, New Jersey, have been on strike for two weeks, according to USW’s Mike Fisher, director of sub-district 7.

Around 100 employees work at that site, which produces food cans, he said. Essentially all production, maintenance, shipping and receiving staff are unionized. Some of the biggest areas of contention are around cost-sharing levels for health insurance as well as the company taking daily overtime out of the workers’ contract.

Silgan did not respond to requests for comment.

Bargaining began in January and the three-year contract expired in late February, according to Fisher.

The contract had been extended, and the parties had at least 20 bargaining sessions, Fisher said. New Jersey’s AFL-CIO issued a solidarity alert on April 22, the day the strike began.

Hourly employees make up 75% of Silgan’s workforce, according to the company’s most recent annual report. One-third of those hourly plant employees in the U.S. and Canada are represented by various unions. The company reported that contracts covering about 13% of hourly employees would expire in 2024. “We expect no significant changes in our relations with these unions,” the company said in the report.

Silgan this week reported first-quarter results for 2024. Net sales fell 7% year over year to $1.34 billion. For metal containers specifically, where more than half of its volumes are in pet food, net sales fell 8% to about $617 million. Volumes there were down 5%, impacted by customers’ first-half destocking initiatives, the company said.

“In Metal Containers, we continue to make progress on our cost reduction initiatives during the quarter and believe we are well-positioned to service the market from our low-cost manufacturing network, while maintaining the ability to grow volume through our market-leading pet food platform,” CEO Adam Greenlee said on a Wednesday earnings call.

Last year, Silgan announced a $50 million cost-reduction program through the end of 2025. “It is about optimizing the footprint, taking growing volume and putting it in more efficient facilities and driving improvement in that manner,” Greenlee said at the time. Layoffs happened at Silgan Containers facilities in Illinois and Tennessee late last year.

Greenlee did point out on the recent earnings call that fruit and vegetable volumes, which represent 20% of the metal containers business, are expected to decline in 2024 due to one customer’s notable North American pullback this year.