Brands put much consideration into their primary packaging substrates. But other often invisible parts of a package, like coatings, also play an important role in meeting sustainability goals. Today, multiple starch-based coating companies are expanding, driven by customers facing regulatory pressures and environmental concerns.

Starch is a polymeric carbohydrate found in plants. Various starch sources are being explored as a base for paper packaging barriers, including wheat, tapioca, potato and corn. Grease barriers made from these materials often are considered a more sustainable, biodegradable option when compared with traditional barriers that contain plastics and PFAS. The abundance of starch can also make it a relatively inexpensive biopolymer.

Research is ongoing into how starch can be incorporated into coatings that replace per- and polyfluoroalkyl substances. While sensitivity to moisture can be a drawback of starch-based packaging components, researchers have found that incorporating bioactive components, such as antimicrobial agents or antioxidants, can mitigate these limitations. And at Michigan State University, researchers are combining starch with zein, a protein found in corn, for a dual-layer coating that provides grease resistance benefits.

Ingredion, a company that manufactures and sells industrial starches to paper and packaging producers, this year announced a $50 million investment in a facility in Cedar Rapids, Iowa, to expand the company’s specialty industrial starch capacity. The company hopes to break ground at the end of Q3.

Chris Plant, Ingredion’s senior director for industrial ingredients in the U.S. and Canada, pointed to two sectors that have driven growth in recent years: e-commerce and food service.

For food packaging applications, some starch-based coatings have barrier properties such as oil and grease resistance, as well as an oxygen transmission rate “at a level that is comparable with some of the traditional synthetic avenues for the same applications.”

Demand for these PFAS replacements “starts at the consumer level,” said Ingredion’s Jake Finkelstein, senior analyst for marketing of industrial ingredients. Similarly, plant-based ingredients company Roquette has developed Stabilys BA 25, a starch-based solution and alternative to PFAS that provides oil and grease resistance without any use of fluoropolymer.

These innovations come as over a dozen U.S. states have enacted laws addressing PFAS substances in food containers and packaging materials, with bills pending in many others.

For the retail use case, lightweighting is a key driver.

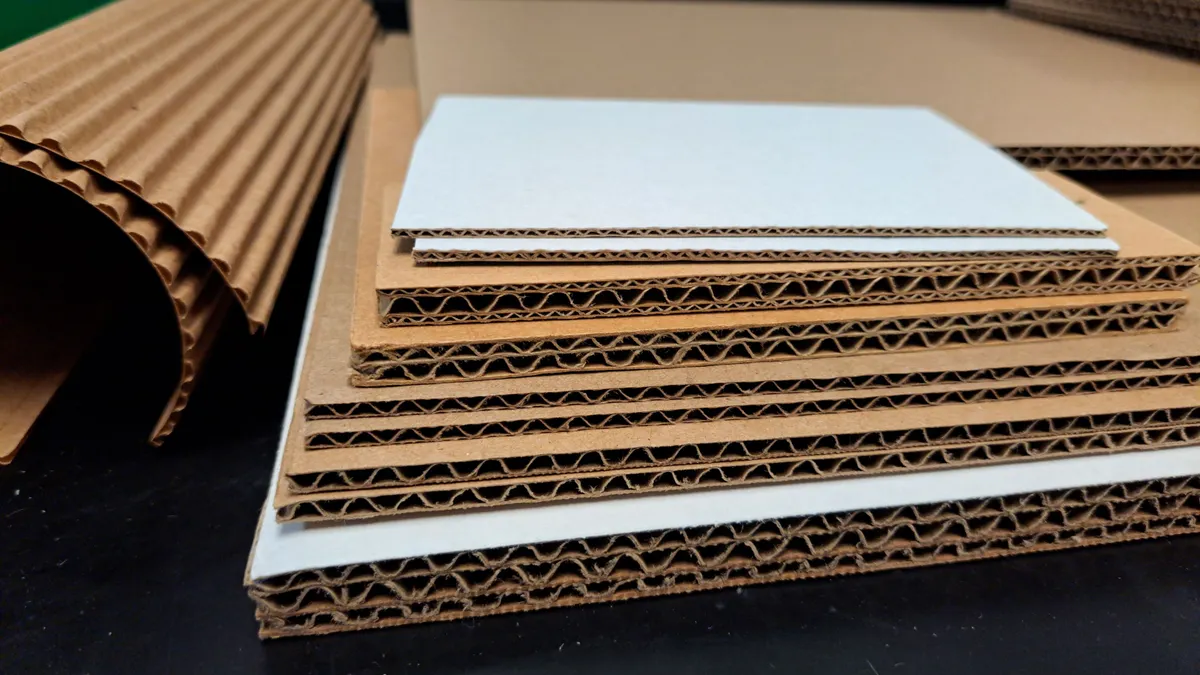

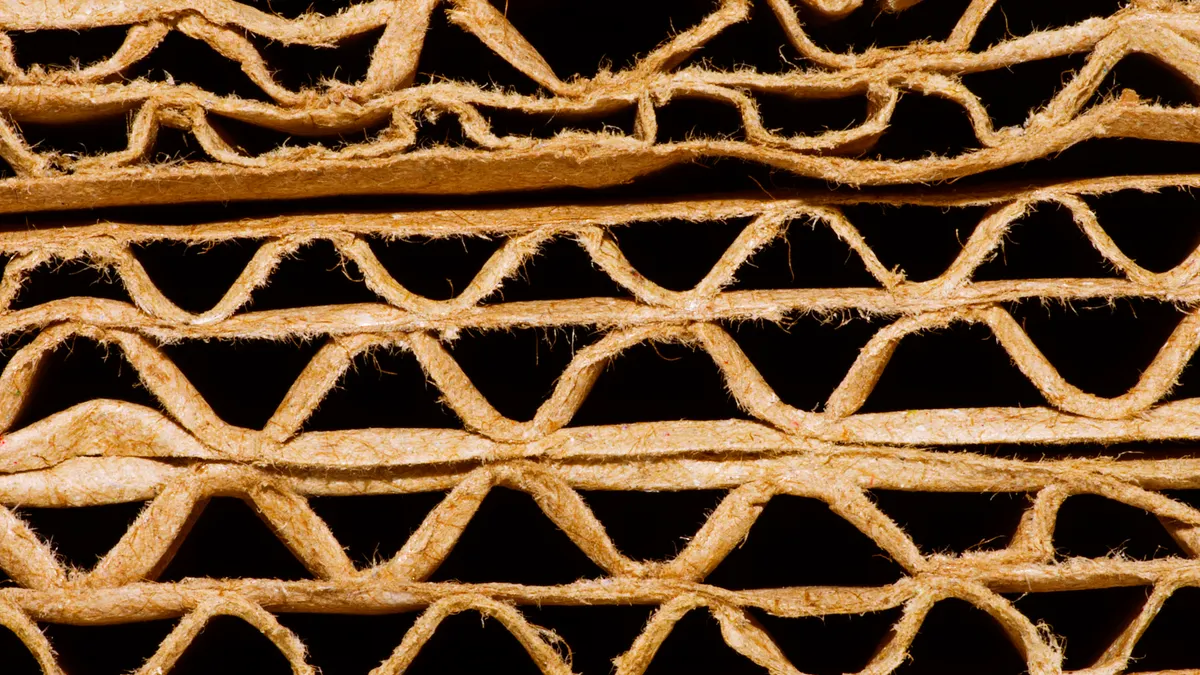

Traditionally, paper packaging producers have incorporated starch to enhance the strength and structural integrity, Plant said. Using starch also allows for a lower fiber content in the packaging, so starch-based coatings might help companies reduce the overall weight without compromising the packaging’s performance.

In addition to starch coatings wholesale replacing conventional barriers, they can also be used as part of a layered packaging approach to improve separability, and therefore recyclability, of other materials. This addresses a key challenge in the recycling process — fused materials — with such hard-to-recycle multilayer packaging often ending up in landfills. Without starch, separating these elements could require solvents, which are costly and generate chemical waste.

Industrial polymer supplier Kuraray sells Plantic, a starch-derived, biobased plastic. Its Plantic EP resin product is used to develop sustainable gas and aroma-barrier solutions for paper, paperboard or films. It can be used as a replacement for, or in conjunction with, other barriers.

“We saw this trend in the market of moving towards paper packaging,” said Kuraray’s Tom Black, director of international sales for Plantic. He pointed out that in the case of high-barrier multilayered structures, recycling is a challenge.

Plantic can be applied between the layers of fused materials to aid separation at end of life, which improves recyclability, Black said. Additionally, when used with a material like foil, it also provides an extra layer of protection “should the foil get scratched or scored.”

Customers who are showing the greatest interest in Plantic’s barriers include those in pet food, personal care and dry goods like powders and cereals.

But starch-based coatings might have stiff competition from other sustainable alternatives, particularly those derived from seaweed. Amcor’s Lift-Off Sprints challenge aims to support innovative companies that provide compostable or recyclable barrier coating solutions for paper and other compostable substrates. Producers innovating with seaweed have captured the attention of Frank Lehmann, vice president of corporate venturing and open innovation at Amcor, who thinks they show promise.

“Some of them looked like they have cracked the code,” he said. Another promising strategy for oxygen and moisture barriers is to combine coatings made from different materials, Lehmann added.

Customers demand components that enable a whole package to be recyclable or compostable, Lehmann said, He added that the product also needs to be within the cost range they expect.

The Ingredion team also highlighted how they’re working with their customers and thinking about total cost of performance: It takes a balance of factors including equipment mechanics, substrate properties and coating chemistry. Modifying starches to enable specific functionalities adds a cost to the base material.

“For example, we take unmodified starch and oxidize it to produce a viscosity-controlled oxidized starch that will be more expensive upfront, but will provide more functionality and value to meet the customer’s need,” said Finkelstein.

Balancing functionality, appropriateness for a customer’s application and cost can be a challenge. “Despite the comparable performance of emerging alternatives, treating paper with PFAS remains the most cost-effective option,” declared a recent study of fiber-based products from the Department of Forest Biomaterials at North Carolina State University.

The study found that the cost of PFAS treatment per square meter is $0.00012, compared with $0.015 to $0.98 with biobased alternative coatings. The transition away from PFAS could cost industry up to $12.5 billion more.

But for many companies, moving to a starch-based coating and reducing synthetic additives “could give them that recyclability [and] compostability claim that they’re looking for,” Plant said.