Like the rest of the business world, packaging companies and their customers are eagerly awaiting clarity on measures President-elect Donald Trump will begin to take once in office — which could shape dealmaking and investment decisions in the year to come.

States are also poised to wield their own influence through renewed policymaking and legal efforts. 2025 could also offer greater clarity on how companies see their public-facing sustainability strategies and approaches to plastic reduction evolving in future years.

These are some of the top factors that sources say could influence the year in packaging business, policy and sustainability. What else are you tracking in 2025? Send us an email at [email protected].

Tariffs and potential changes loom under a new administration

Trump is predicted to spur economic and regulatory changes with implications for the packaging industry.

Although tariffs aren’t a new element of U.S. policy (in some cases they’re already affecting certain types of packaging), the president-elect’s proposed strategy could have a much broader effect on the economy.

Analysts from firms such as RaboResearch say that universal baseline tariffs, or tariffs targeting specific countries, could affect overall U.S. inflation rates. There’s potential for tariffs to have an indirect effect on recycled fiber, in turn affecting containerboard, Resource Recycling recently reported. Meanwhile, BofA Research noted that tariffs could potentially give a boost to sectors such as the domestic glass market. And sectors such as flexible packaging are concerned about how tariffs might affect aluminum and related inputs.

Industry groups are also watching and wishing for change in other areas. Multiple trade groups, including some representing packaging manufacturers, signed on to a December letter from the National Association of Manufacturers asking Trump to revisit policies related to PFAS, facility emissions, labor, a global plastic treaty and more.

One key agency to watch will be the U.S. EPA. While some of the EPA’s packaging and recycling-related actions tend to be more advisory, it does have authority to regulate emissions and chemicals, which would directly affect manufacturers. Observers are preparing for potentially sweeping changes in personnel and priorities at the agency in the months ahead.

Meanwhile, observers expect that new leaders overseeing the U.S. Food and Drug Administration with a “Make America Healthy Again” focus could formulate changes in areas like food additives.

Packaging policy negotiations mature

By now, the industry is well-accustomed to plastics and packaging being the subject of sustainability-driven bills across statehouses. 2025 is poised to show how different stakeholders have learned from roadblocks and compromises in past legislative sessions. They're also learning as states begin to implement EPR, recycled content or other emerging categories of regulation.

This all comes in a shifting political landscape and amid continued conversations about future opportunities for federal harmonization.

It will be a milestone year for EPR, with Oregon as the first guinea pig U.S. state expected to officially start its program. Eyes are also on legislatures in New York, Tennessee and other states to advance EPR bills. Metal packaging proponents again want to see EPR policies developed alongside recycling refund legislation, or deposit return systems, in states including Washington and Illinois.

The trajectory of labeling policy is also a growing concern. With days to go in the Biden administration’s tenure, the Federal Trade Commission remains silent about new updates in the yearslong review of its Green Guides – national guidelines influencing what sustainability claims or disposal symbols can be printed on packaging. Groups have also worked on future bill proposals for Congress that could address what’s often viewed as a problematic patchwork of labeling rules across states.

With those national interests, the packaging industry is looking to grow its voice at the federal level. For example, the Flexible Packaging Association launched a political action committee last year and expects to begin vetting candidates to support, with a focus on congressional races.

Other notable regulatory changes coming in North America include Canada’s buildout of a federal plastics registry tracking the amount of plastic on the market, disposal outcomes and more. Phase one of reporting requirements begins in September.

Businesses also have this year to prepare for the EU’s upcoming Packaging and Packaging Waste Regulation, which after some final steps would likely come into force in 2026. Just around the corner are 2030 requirements and targets related to waste reduction, minimum recycled content, lightweighting and reuse.

Industry consolidation advances in North America, with international involvement

Right up until year's end, 2024 brought large-scale merger and acquisition announcements. This activity shows no sign of slowing, at least in early 2025, as analysts point to an uptick in M&A following a relatively modest period. And the influence of international companies on the North American market is expected to grow.

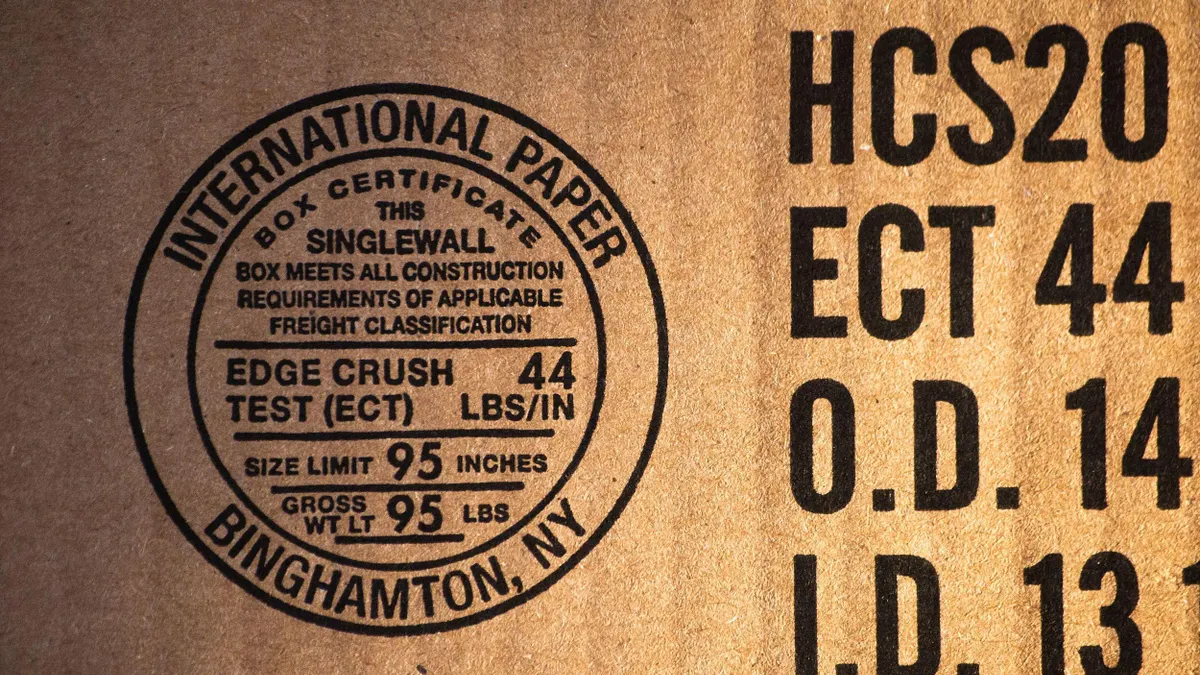

While fiber companies initially dominated the 2024 megadeal discussions, plastic packaging producers made their presence known by year's end. Multiple megadeals are projected to close in 2025, including International Paper's acquisition of DS Smith and Novolex’s acquisition of Pactiv Evergreen.

Brazil-based Suzano unsuccessfully made a play for International Paper early in 2024, and then it broke into the U.S. market by acquiring two Pactiv Evergreen mills in Q4. Suzano is rumored to be considering submitting an offer for Washington-based Clearwater Paper, after repeatedly expressing its desire for expansion in North America.

Some analysts have said that greater consolidation could hurt competitive dynamics in certain packaging sectors. M&A dynamics also face potential changes due to expectations that the Trump administration could loosen antitrust regulation.

Facility footprint decisions could be swayed by changing federal incentives

In the new year, companies' decisions to open, close or invest in facilities may hinge in part on industry consolidation and new leadership in Washington, D.C.

Some company executives have expressed concern that infrastructure funding offered under the Biden administration will dry up, such as money allocated for procuring energy-efficient or lower carbon manufacturing equipment. But others believe that potential tax breaks or incentives expected under Trump could fuel equipment purchasing and footprint expansion decisions.

For instance, Trump has floated policy ideas to boost manufacturing that include expanding research and development tax credits and lowering corporate tax rates for companies that produce goods domestically. On the flip side, he has vowed to repeal the Inflation Reduction Act. That legislation has funded projects for energy-intensive industries, including decarbonization and emissions-reducing equipment upgrades for companies such as International Paper, O-I Glass and others.

Demand rebounds and growth prospects that would prompt investments vary by sector, according to analysts. For instance, a surge of containerboard plants came online in the past few years, and then capacity quickly halved amid weak demand. U.S. producers could remove up to 2.5 million additional tons of containerboard capacity from their footprints in the next five years, according to Wells Fargo Corporate & Investment Banking analysts.

As with the M&A trend, international companies also are garnering attention for making investments in North American operations.

In October, Greece-based Flexopack revealed its intention to build its first U.S.-based flexible packaging facility, in Pennsylvania. In November, Netherlands-based Nelipak announced it had opened its first North American flexible packaging production site, in North Carolina. And already this month, Nigeria-based The Paper Packaging Co. disclosed its plan to establish a presence in the U.S. early in 2025.

Is 2030 the new 2025 for plastic reduction targets?

It’s now 2025 and the world’s largest brands haven’t all converted to more circular packaging as many organizations’ goals had laid out. A changing social and political environment offers a potential turning point or opportunity to double down on potentially redesigned packaging sustainability strategies and expectations going forward.

Some major companies publicly acknowledged this reality. Unilever shared an updated list of targets bound to different dates over the next decade. For organizations that have voluntarily aligned with the U.S. Plastics Pact, a road map to reducing virgin plastic and upping recycling and recycled content use was last year updated and shifted from 2025 to 2030.

Throughout this year and into next, companies could share more on lessons learned from the lead-up to 2025 and new approaches to next-generation targets. This could result in better-informed, more individually tailored goal-setting for the future.

Globally, although an internationally binding agreement on preventing plastic pollution was slated to be decided in 2024, negotiations are expected to continue in 2025 – this time with U.S. representation falling under a Republican administration.

It remains to be seen how regulatory and political tides shifting away from ESG will impact sustainability pressure and ambition – greenhushing could be a concern – when many companies have pointed out that those efforts were underpinned by consumer demand anyway.

Local and state governments and environmental advocates seek to leverage the judicial system to lobby for change, but high-profile cases are hitting roadblocks. The New York attorney general’s lawsuit against PepsiCo over plastic pollution was dismissed in November. California’s attorney general is in a court battle with ExxonMobil: It sued the company last year, including for alleged limitations around mechanical and chemical recycling; the company countered with its own lawsuit this week, alleging defamation.